Report: Homeownership in DC Area 43 Percent Cheaper Than Renting

Report: Homeownership in DC Area 43 Percent Cheaper Than Renting

✉️ Want to forward this article? Click here.

Trulia’s latest Rent vs. Buy Report released Thursday morning stated that homeownership is 43 percent cheaper than renting in the DC area.

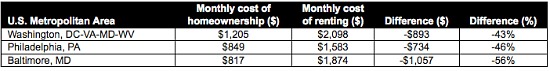

In their newest report, the analytic arm of the real estate website compared the average cost of renting versus owning for homes in DC, Maryland, Virginia and a small portion of West Virginia. Their calculations reveal that homeownership is not only cheaper than renting in the DC area, but in all of the 100 largest metro areas in the U.S. The degree to which it is cheaper varies; in Honolulu, for example, buying is 24 percent cheaper than renting, but in Detroit, buying is 70 percent cheaper. In the DC area, Trulia determined that on average, renting is $893 more expensive per month than owning.

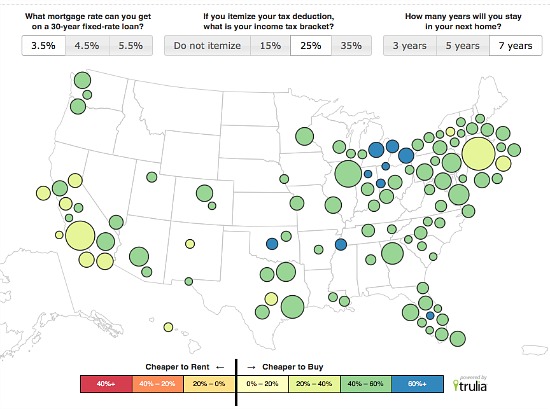

Courtesy of Trulia Trends

It is important to know that in coming to these conclusions, Trulia assumes that owners will stay in their homes for at least seven years, secure a low mortgage rate, and take appropriate tax deductions (and, as the commenter below points out, does not take into account the maintenance and improvement costs associated with home ownership). Without these conditions, some of the cities tipped out of the group, with ownership becoming more expensive than renting. Trulia created an interactive map that allows you to play with these factors and see what happens when, for example, you only want to stay in your home for 5 years.

“Homeownership is cheaper than renting in all of the 100 largest metros, by a wide margin,” said Jed Kolko, Trulia’s Chief Economist. “Despite the recent price rebound, rents continue to rise faster than prices, and mortgage rates are near record lows. Homeownership makes the most financial sense for people whose strong credit scores let them snag the lowest mortgage rate and who get the biggest benefit from deducting mortgage interest and property taxes from their income taxes.”

To determine the percentage, Trulia looked at all the for-sale homes and rentals on their site. “On for-sale homes, we took the asking price and estimated what it would rent for; for rentals, we took the asking rent and estimated what it would sell for. That way, we can calculate the average rent and asking price for an identical set of properties in a metro area, for a direct apples-to-apples comparison,” stated Kolko.

However the issue with the report, from our perspective, is that DC’s averages seem unlikely to be comparable. The report states that the average monthly cost of owning in the DC area is $1,205 per month, while the average rent is $2,098; the two properties you imagine representing those averages are almost certainly quite different from each other. Since the region that Trulia considers the DC area is so broad, it appears that the owning costs are brought down significantly by regions outside the city.

To see Trulia’s full post and interactive graphic, click here.

See other articles related to: rent vs buy, renting in dc, trulia trends

This article originally published at https://dc.urbanturf.com/articles/blog/report_homeownership_in_dc_43_percent_cheaper_than_renting/6019.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro