What's Hot: Just Above 6%: Mortgage Rates Drop To 2022 Lows | Facebook Co-founder Lists DC Home For Sale

Report: DC Residents Pay Lowest Taxes In The Region

Report: DC Residents Pay Lowest Taxes In The Region

✉️ Want to forward this article? Click here.

Greater Greater Washington recently analyzed a report from the DC Fiscal Policy Institute that found that DC residents (and Virginians without cars) pay some of the lowest taxes in the region.

The report totaled the income, property and car taxes for three separate (and hypothetical) groups — renters earning $50,000 a year, homeowners with $100,000 in annual income and homeowners earning $200,000 a year. (The study analyzed singles and married couples with no children and with two children.) The study did not, however, include sales or income tax in its methodology.

From GGW:

In almost all scenarios, DC’s tax burden is the lowest. The major exception is single households without or with children, where taxes are lower in Virginia. For married couples, Virginia’s taxes rise above DC’s mostly due to the car tax. A separate DC CFO analysis also studied homeowners earning $50,000, and also found lower taxes in DC than in Maryland and Virginia.

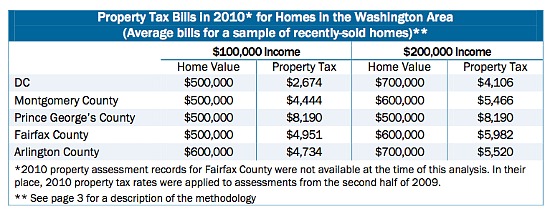

DC also fared well when property taxes alone were considered. The study (which has sparked some criticism in the comments section of the Greater Greater Washington post) compared property taxes for $500,000 and $700,000 residences in DC and the close in Maryland and Virginia counties for households earning $100,000 and $200,000 a year. As the table below indicates, DC residents come out paying the least in property taxes (although that is fairly common knowledge in the area).

Table from DCFPI

To read the full study (and decide for yourself how accurate its methodology is), click here.

See other articles related to: greater greater washington, taxes

This article originally published at https://dc.urbanturf.com/articles/blog/report_dc_taxes_arent_that_bad/3040.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro