What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Rents Rise in NoMa and H Street, Fall on Capitol Hill

Rents Rise in NoMa and H Street, Fall on Capitol Hill

✉️ Want to forward this article? Click here.

The Apartments at CityCenter

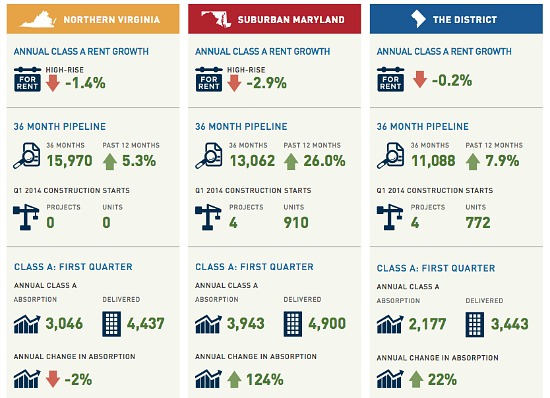

Class A apartment rents in the region fell 0.4 percent in the first quarter of 2014 versus the previous year, according to a report out late last week. But in a few pockets, rents rose even as new product continued to hit the market.

The Delta Associates report analyzing the regional apartment market in the first quarter of 2014 states that rents for Class A apartments in sub-markets including NoMa/H Street (+4.6 percent) and Prince William County (+8.1 percent) increased over the last 12 months. However, in the three jurisdictions of DC, Suburban Maryland and Northern Virginia, rents for new apartments fell, and in some areas the drop was pronounced. For example, in South Arlington, rents fell just over 6 percent, while on Capitol Hill and Capitol Riverfront rents dropped 2.6 percent

From Delta Associates:

Washington apartment market metrics continue to be affected by a rising tide of supply. However, due to record setting absorption, the Class A stabilized vacancy rate improved to 4.5%, down from March 2013 when it stood at 4.9%. The already oversized 36-month development pipeline grew to the highest level we have ever recorded in the Washington region, 40,120 units at March 2014.

Here is a quick snapshot of average rents for Class A apartments in DC area sub-markets, as defined by Delta:

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,812 a month

- Upper Northwest: $2,654 a month

- Columbia Heights/Shaw: $2,599 a month

- NoMa/H Street: $2,358 a month

- Capitol Riverfront: $2,222 a month

- Rosslyn-Ballston Corridor: $2,382 a month

- South Arlington: $2,066 a month

- Bethesda: $2,574 a month

Note: The rents are an average of studios, one and two-bedroom rental rates at new buildings in the DC area.

The report released last week looked at Class A apartment projects. Later this week, UrbanTurf will take a closer look at the state of the Class B market.

Definitions:

- Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: delta associates, rental incentives, renting, renting in dc

This article originally published at https://dc.urbanturf.com/articles/blog/rents_rise_in_noma_h_street_fall_on_the_hill/8322.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro