Rents Drop at DC Area's Class B Apartments as Vacancies Rise

Rents Drop at DC Area's Class B Apartments as Vacancies Rise

✉️ Want to forward this article? Click here.

1500 Massachusetts Avenue NW

UrbanTurf has already projected that 2014 will be the year of the renter in the DC area. That’s because the number of new buildings going up in the region is catching up with (and in some cases surpassing) demand. That same increase in inventory is affecting rents in older buildings, which are expected to drop in the area this coming year, according to a new report.

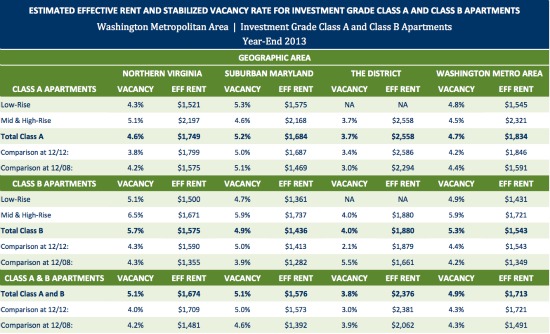

The report, issued by real estate research firm Delta Associates, looks at changes in the Class B apartment market over the previous year. Class A apartments are typically large buildings built after 1991, with amenities like gyms, pools and more (UrbanTurf reported on the changes in the Class A market last week). Class B buildings are generally older buildings that have been renovated or have more limited amenities (privately rented homes aren’t included in the analysis).

Class B vacancies rose to 5.9 percent in 2013, up 1.8 percent from 2012, and DC rents decreased by 1.1 percent over the year. Northern Virginia rents also dipped by 1 percent, as suburban rents in Maryland rose by 1.5 percent.

Those figures are in stark contrast to a 2012 third-quarter report, when UrbanTurf reported that finding a Class B apartment in DC could be a “virtually impossible” task.

Though the report projects that vacancy will stay under control through the year, it predicts a continuing downward trend in rents as more Class A units open up.

That’s good news for renters. Among other things, the nicer, newer Class A inventory should drive Class B properties to renovate and offer renters both more competitive rent and more amenities than they have in the past. The report noted:

- More than 31,878 Class B apartments are currently being renovated.

- The renovation budget averages $24,375 per unit.

- Renting a renovated Class B apartment can still be a better deal than renting a new Class A apartment.

Here is a quick snapshot of average rents for Class B mid- and high-rise apartments in DC area sub-markets, as defined by Delta:

Delta Associates projects that the low rents and high vacancy will be “shallow and short-lived.” But in the meantime, the advantage goes to the renter this year.

Similar Posts:

This article originally published at https://dc.urbanturf.com/articles/blog/rent_drops_slightly_in_districts_class_b_apartments_as_vacancy_rises/7992.

Most Popular... This Week • Last 30 Days • Ever

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The 30,000 square-foot home along the Potomac River sold at auction on Thursday night... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro