What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

New Report Shows Homeowners Have A Lot of Negative Equity

New Report Shows Homeowners Have A Lot of Negative Equity

✉️ Want to forward this article? Click here.

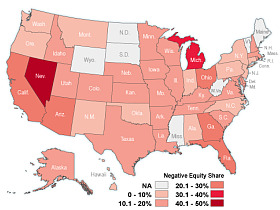

A new report from the Government Accountabilty Office (GAO) examines how many homeowners in the country have negative equity and the news is not good, even in DC.

Using Case-Shiller data, the report estimated the number of active nonprime borrowers whose homes are underwater in 16 metro areas, according to The Wall Street Journal Developments blog. The list was led by the usual suspects, Las Vegas (94%), Phoenix (89%) and Miami (86%) with the percentage referring to borrowers who are still current on their loans, but have negative equity. However, DC was not far behind with 64% of borrowers with negative equity.

The overall numbers are a touch depressing. From Developments:

In the markets (that the report examined), more borrowers who bought new homes, as opposed to refinancing their mortgage, ended up with negative equity. Around 68% of borrowers who took out a new loan to buy a house have negative equity, versus 55% of borrowers who refinanced and took cash out of their home and 50% of borrowers who refinanced but didn’t take out any cash.

To read the whole report, click here.

See other articles related to: national trends

This article originally published at https://dc.urbanturf.com/articles/blog/new_report_shows_homeowners_have_a_lot_of_negative_equity/1684.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro