New Inclusionary Zoning Rules in DC Will Take Effect in June

New Inclusionary Zoning Rules in DC Will Take Effect in June

✉️ Want to forward this article? Click here.

With demand for housing in the District at historic highs, it is no wonder that affordable housing is scarce throughout the city for both low- and moderate-income households.

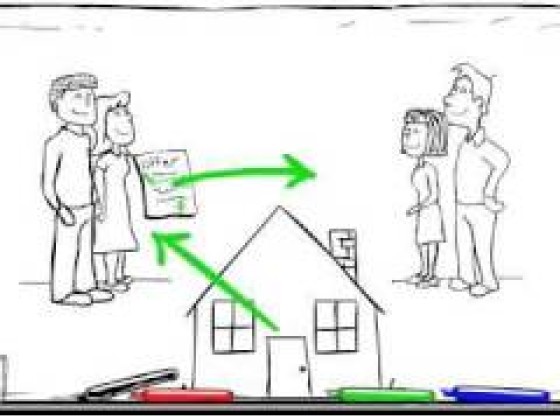

Now, the city is attempting to leverage its existing system of inclusionary zoning (IZ) in hopes that the program will assist those who need it most.

Last summer, the Zoning Commission voted in favor of mandating that all new IZ rental units be affordable, at minimum, to households earning up to 60 percent of the median family income (MFI) rather than the current 80 percent threshold; the standard will still be 80 percent for for-sale units. These new rules will take effect on June 5th.

story continues below

loading...story continues above

Developers who demonstrate economic hardship in meeting the requirements on-site will still be able to secure a waiver in exchange for creating affordable housing elsewhere. The required IZ set-aside for for-sale developments can be reduced by 20 percent if the IZ units that remain are earmarked for households earning up to 60 percent median family income.

Currently, IZ allows developers zoning relief to construct denser projects than what is allowed by-right on a given site by mandating that a percentage of the housing units be set aside for households earning less than the area median income (AMI). However, developers would often set aside the required units for households earning up to 80 percent AMI — still a relatively generous salary for an area whose 2016 AMI was $108,600.

The Department of Housing and Urban Development (HUD) calculates AMI/MFI for all metropolitan areas nationwide. HUD’s median family income for the District specifically and for the DC metro area more broadly is $110,300 for fiscal year 2017.

See other articles related to: affordability, affordable housing, affordable housing dc, inclusionary zoning, zoning changes, zoning commission

This article originally published at https://dc.urbanturf.com/articles/blog/new_iz_rules_take_effect_june_5th/12512.

Most Popular... This Week • Last 30 Days • Ever

A look at the closing costs that homebuyers pay at the closing table.... read »

3331 N Street NW sold in an off-market transaction on Thursday for nearly $12 million... read »

Paradigm Development Company has plans in the works to build a 12-story, 110-unit con... read »

The most expensive home to sell in the DC region in years closed on Halloween for an ... read »

The development group behind the hotel has submitted for permit review with DC's Hist... read »

- How Do Closing Costs Work in DC

- Georgetown Home Sells For $11.8 Million, Priciest Sale in DC In 2024

- 110-Unit Condo Project Planned in Alexandria Coming Into Focus

- The Cliffs in McLean Sells For $25.5 Million, Highest Home Sale In DC Area In Years

- Georgetown Hotel That Is Partnering With Jose Andres Looks To Move Forward

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro