New Condo Supply in DC Area Hits Record Low As Sales Pace Accelerates

New Condo Supply in DC Area Hits Record Low As Sales Pace Accelerates

✉️ Want to forward this article? Click here.

Courtesy of Delta Associates

Real estate research firm Delta Associates released its fourth quarter 2012 report on the DC metro area condo market on Monday, which revealed that the inventory of new condos in the region has reached a record low as the sales pace for new buildings has skyrocketed. Following are a few of the key findings from the report:

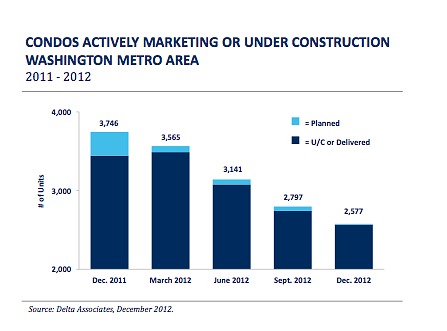

- In the DC region, there are currently 2,577 new condo units under construction or being marketed. What that translates to is just 12 months of new condo inventory, based on current sales pace. This is down notably from last July when the inventory stood at 3,629 units, and a fraction of the inventory from five years ago, when the area’s inventory of new condos was near 20,000.

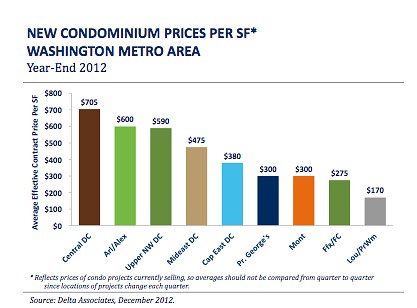

- As was the case when Delta released its numbers for the third quarter of 2012, inventory varies drastically based on sub-market: “In upper NW DC, there is virtually no new inventory available, but in Loudoun County, there is 2.0 years of inventory.”

- One of the reasons that inventory is so low is due to the fact that the sales pace at new buildings has increased exponentially over the last year. Specifically, projects that have been introduced to the market in the prior 12 months have sold at a pace of 10.5 units per month; in contrast, projects that have sold out since 2011 averaged 2.8 sales per month. (It is important to note when looking at this differential that the final units to sell in a project are usually the least desirable. Still, the increased sales pace is noteworthy.)

- New condo prices have risen 3.7 percent across the DC area on average, but the numbers vary based on sub-market. For example, prices rose by double digits in Arlington/Alexandria, but fell 3.2 percent in a wide swath of DC that includes Capitol Hill, NoMa, Capitol Riverfront and communities East of the River. One of the authors of the report explained to UrbanTurf that prices dropped in this section of the city because “most of the actively marketing inventory in Capitol East is stale product [that is] units that have been selling for over five years.”

- The aggregate number of new condo sales across the DC metropolitan area in 2012 was 2,046, up from 1,617 in 2011.

See other articles related to: condos, dc condo market, dc condo prices, dc condos, dclofts, delta associates

This article originally published at https://dc.urbanturf.com/articles/blog/new_condo_supply_in_dc_area_hits_record_low_as_sales_pace_accelerates/6485.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro