What's Hot: The Zones That Could Lead To More Development in Chevy Chase Set To Go Before Zoning Commission

Mortgage Demand Slow To Respond To Falling Rates

Mortgage Demand Slow To Respond To Falling Rates

✉️ Want to forward this article? Click here.

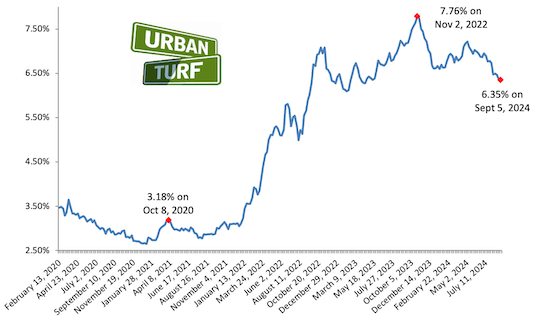

Mortgage demand continues to be slow to respond to falling interest rates.

Rates dropped for the sixth week in a row last week and total mortgage application volume rose just 1.4%, the Mortgage Bankers Association (MBA) reported on Wednesday. Applications to purchase a home rose 2% week-over-week, and refinance applications increased 1%.

“There is still somewhat limited refinance potential as many borrowers still have sub-5 percent rates," MBA economist Joel Kan said in a release. “Despite the drop in rates, affordability challenges and other factors such as limited inventory might still be hindering purchase decisions.”

See other articles related to: mortgage demand

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_demand_slow_to_respond_to_falling_rates/22698.

Most Popular... This Week • Last 30 Days • Ever

A look at the closing costs that homebuyers pay at the closing table.... read »

3331 N Street NW sold in an off-market transaction on Thursday for nearly $12 million... read »

Today, we take an updated look at the pipeline of larger residential development on t... read »

As we continue to delve into metrics that shaped the DC-area housing market this year... read »

The development group behind the hotel has submitted for permit review with DC's Hist... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro