Mortgage Demand Cools But Remains Resilient

Mortgage Demand Cools But Remains Resilient

✉️ Want to forward this article? Click here.

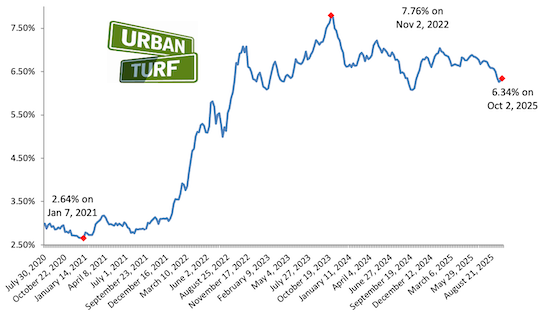

Mortgage demand cooled last week, according to the Mortgage Bankers Association on Wednesday.

The MBA’s Market Composite Index, which tracks overall mortgage application volume, slipped 4.7% from the prior week, with an unadjusted drop of about 5%. Refinance activity fell 8% for the week, while the purchase index fell 1%.

Still, the broader annual trend remains somewhat resilient. On an unadjusted basis, purchase applications are up 14% year-over-year, and refinance volume remains elevated compared to a month ago. The MBA noted shifts in market mix, too: the adjustable-rate mortgage (ARM) share ticked up to 9.5% of total activity (from 8.4% the prior week); 5/1 ARM rates are averaging nearly a full percentage point below 30‑year fixed rates.

“With mortgage rates on fixed‑rate loans little changed last week, refinance application activity generally declined," Mike Fratantoni said. "Purchase activity declined by about 1 percent for the week but continues to show moderate growth on an annual basis, and stronger growth for FHA loans, favored by first‑time homebuyers.”

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_demand_cools_but_remains_resilient/23945.

Most Popular... This Week • Last 30 Days • Ever

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

A new mixed-use development would bring hundreds of new residential units and a healt... read »

Georgetown is one of the busiest neighborhoods for development in the city.... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

Capital Bikeshare's record rides; the surging $10 million housing market; and how a S... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro