Mortgage Rates Dropped to Historic Lows, And Then the Demand Came

Mortgage Rates Dropped to Historic Lows, And Then the Demand Came

✉️ Want to forward this article? Click here.

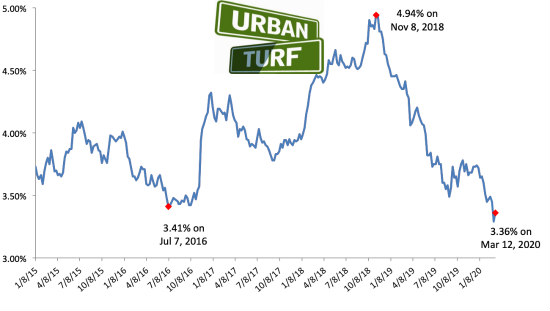

Last week, as the coronavirus spread and the stock market dropped, long-term mortgage rates fell to their lowest level on record.

Enormous demand from prospective homebuyers and homeowners looking to refinance inundated mortgage broker offices with applications.

A couple of days ago, the market responded.

story continues below

loading...story continues above

"From all-time lows over the weekend, rates have moved up to the highest levels in quite some time, a direct result of capacity," Steve Abelman, Senior Advisor at Truist (formerly BB&T) explains. "An unexpected rise in applications fills the funnel quickly, in this case within a few days." Abelman noted that offices staffed to accept 200 applications a day received 300+ per day and don’t have the staff to keep up.

Another lender that UrbanTurf spoke with shortly after the historic rates were announced last Thursday noted that their office put a 30-minute window in place before rates would be raised internally in order to slow demand.

In short, lenders do not have the capacity to process this demand despite efforts to hire and train new personnel. Higher mortgage rates, then, are intended to relieve some of that pressure on the system.

Today, mortgage rates announced by Freddie Mac inched up from all-time lows, which likely means that rates offered by lenders will go up as well. UrbanTurf will continue to monitor rates on a weekly basis.

See other articles related to: freddie mac, interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage-rates-spike-to-slow-high-demand/16583.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

The plan to replace the longtime home of Dance Loft on 14th Street with a mixed-use ... read »

Even with over 1,100 new apartments delivering in the last 18 months, the new develop... read »

This week’s Best New Listings includes a two-bedroom bungalow in Brookland and a to... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- One of DC's Oldest Homes Is Hitting the Market

- Plans For 101 Apartments, New Dance Loft On 14th Street To Be Delayed

- The Nearly 2,000 Units Still In The Works At Buzzard Point

- Best New Listings: The Two-Bedroom House Edition

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro