What's Hot: Douglas Development Files PUD For Large Warehouse At New City Site Along New York Avenue

Mortgage Rates Rise Again, But Still Near Record Lows

Mortgage Rates Rise Again, But Still Near Record Lows

✉️ Want to forward this article? Click here.

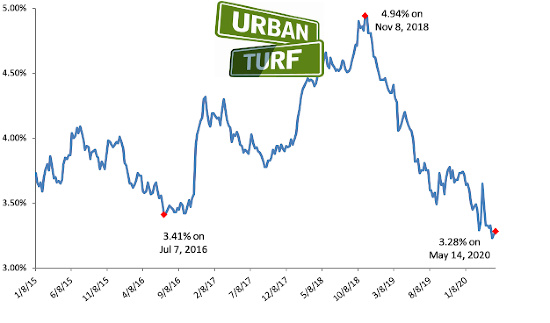

Mortgage rates rose slightly for the second week in a row on Thursday, but still remain just above their all-time low set at the end of April.

On Thursday, Freddie Mac reported 3.28 percent with an average 0.7 point as the average for a 30-year mortgage, up five basis points from the record lows of April 30.

story continues below

loading...story continues above

“Mortgage rates have stabilized at very low levels over the last few weeks as homebuyer demand slowly improves,” Freddie Mac's Sam Khater said in a release. “Although purchase applications reached a new low in mid-April, today purchase demand is only down ten percent from one year ago. While demand is improving, inventory is low and declining with no signs of a turnaround yet.”

The DC-area is experiencing the low supply of homes for sale alluded to above. In April, the number of new listings coming on the market fell to the lowest level for April in ten years, resulting in just a 1.36-month supply of homes for sale.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: interest rates, mortgage rates, record low mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage-rates-rise-again-but-still-near-record-lows/16839.

Most Popular... This Week • Last 30 Days • Ever

When you buy a home in the District, you will have to pay property taxes along with y... read »

The largest condominium building in downtown DC in recent memory is currently under c... read »

The plan to convert a Dupont Circle office building into a residential development ap... read »

The Rivière includes just 20 homes located on the eastern banks of the Anacostia Riv... read »

Why Tyra Banks is serving ice cream in DC; a bike shop/record store opens in Adams Mo... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro