Long-Term Mortgage Rates Flat to Start 2024

Long-Term Mortgage Rates Flat to Start 2024

✉️ Want to forward this article? Click here.

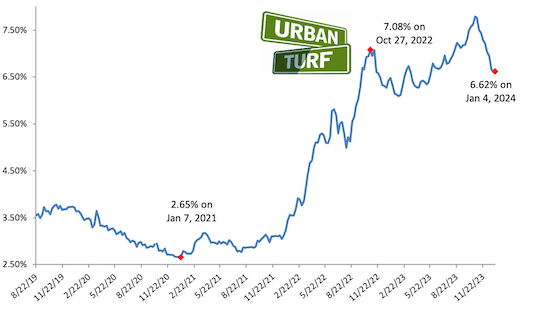

For most of 2023, long-term mortgage rates seemed to just go up. Over the last couple months, however, they have moved in the other direction.

On Thursday, Freddie Mac reported 6.62% as the average on a 30-year mortgage, up 1 basis point from last week, but much lower than when they reached 7.8% back in October.

story continues below

loading...story continues above

“Given the expectation of rate cuts this year from the Federal Reserve, as well as receding inflationary pressures, we expect mortgage rates will continue to drift downward as the year unfolds," said Sam Khater, Freddie Mac’s Chief Economist. "While lower mortgage rates are welcome news, potential homebuyers are still dealing with the dual challenges of low inventory and high home prices that continue to rise.”

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/long-term_mortgage_rates_flat_to_start_2024/21828.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro