Foreclosure Sales in the DC Area Down Significantly in 2012

Foreclosure Sales in the DC Area Down Significantly in 2012

✉️ Want to forward this article? Click here.

It looks like the number of foreclosures in the DC area could indeed be dropping.

In a recent blog post from RealEstate Business Intelligence (RBI), RBI’s Corey Hart takes a look at the state of distressed property sales, both foreclosures and short-sales, in the metro area for the first six months of 2012.

Courtesy of RBI

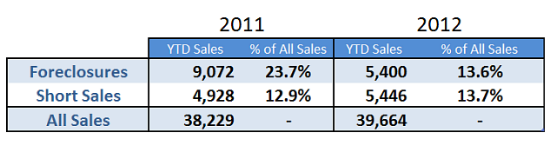

While distressed sales are down, comprising 27.3 percent of all sales in the area for the first half of 2012, compared to 36.6 percent over the same period last year, foreclosure sales are way down, accounting for 13.6 percent of sales during that period versus 23.7 percent last year. Short sales, on the other hand, are up slightly, to 13.7 percent from 12.9 percent.

Perhaps the most interesting takeaway from the report are that the sales of foreclosures are not just lower across the area than they were last year, but have fallen in each of the 45 counties analyzed, an indication that the number of properties in foreclosure proceedings is also falling. For a full run down, click here.

A common explanation for the falling foreclosure rate over the last 12 months (not just in DC, but across the country) is that banks have slowed their processing of this property type, and a large volume of shadow inventory is still waiting in the wings to hit the market. However, according to a few sources, shadow inventory numbers area dropping all over the country, too.

See other articles related to: realestate business intelligence, short sales

This article originally published at https://dc.urbanturf.com/articles/blog/foreclosures_in_the_dc_area_down_significantly_in_2012/5724.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

One of the most ambitious federal housing proposals in years is moving through the le... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- What Is In The Big New Housing Bill?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro