Black Mortgage Applicants in DC Denied at Double Citywide Rate

Black Mortgage Applicants in DC Denied at Double Citywide Rate

✉️ Want to forward this article? Click here.

A new study sheds light on the pervasive pattern of racial disparities in denied mortgage applications.

Black mortgage applicants nationwide are denied at an 80% higher rate than white mortgage applicants, according to Zillow. The homeownership rate for Black households reached 44% in the first quarter of 2020, the highest it has been since 2012, yet remains behind the overall homeownership rate of 65.3%.

While some mortgage denials can be attributed to inadequate or incomplete credit profiles, research has also shown that even when controlling for incomes and credit profiles, Black mortgage applicants are still more likely to be denied.

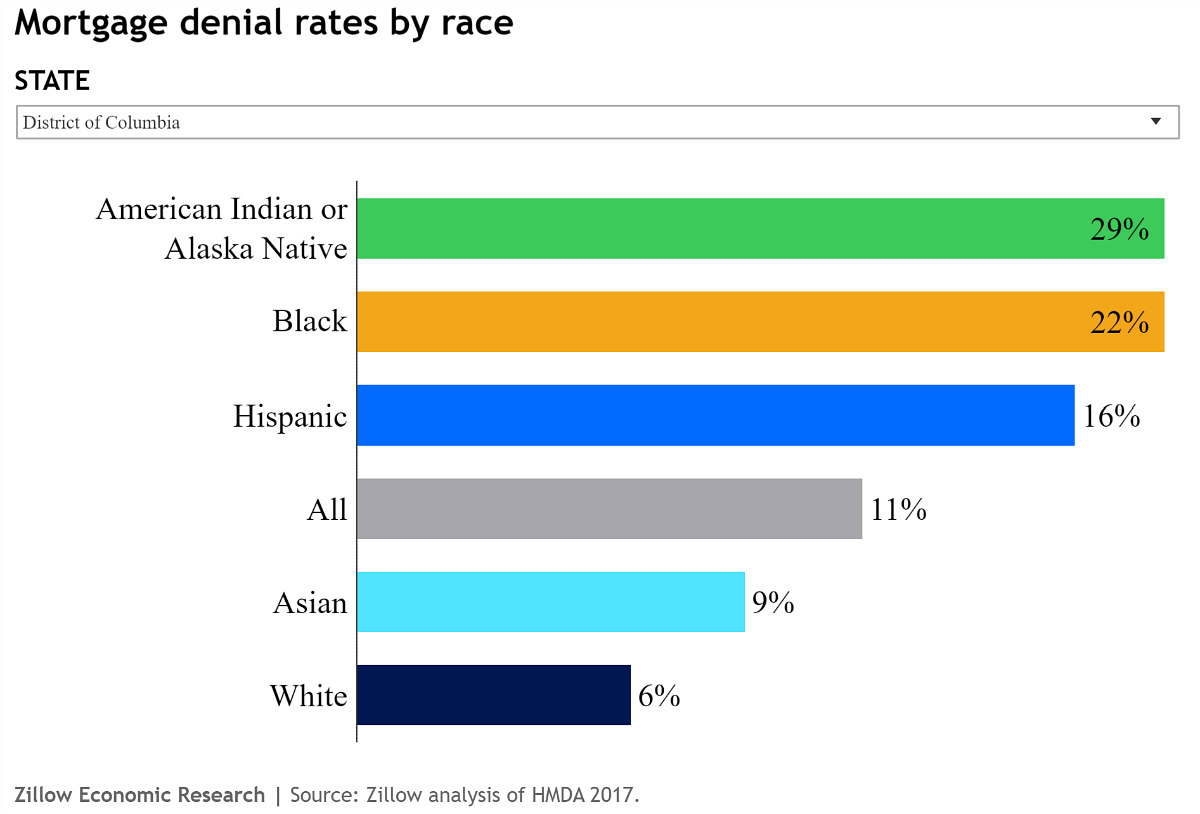

Although there has been more parity with the Black homeownership rate in DC over the decades, mortgage discrimination remains. While the citywide mortgage application denial rate is 11%, the denial rate for Black applicants is twice that (albeit lower than that observed with indigenous and native Alaskan applicants).

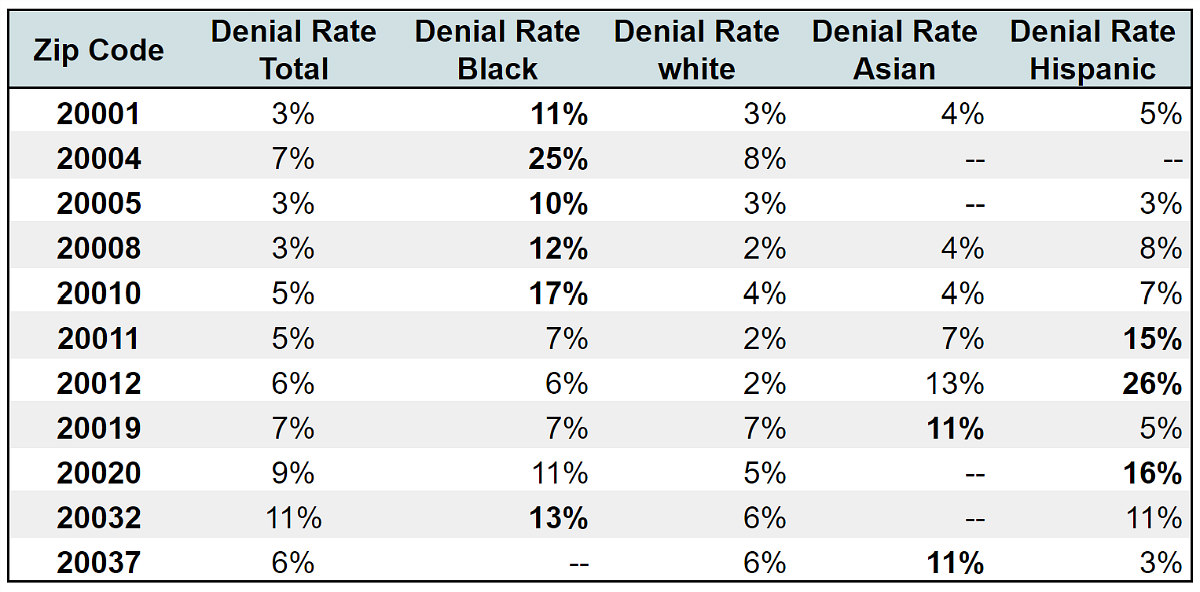

A closer look at the data shows even more drastic disparities in certain zip codes in DC, including among Hispanic and Asian mortgage applicants. The largest mortgage denial disparity is among Hispanic applicants in the 20012 zip code, where they are denied at a rate 333% higher than typical. The second highest disparity is among Black mortgage applicants in the Penn Quarter zip code of 20004, where these applicants are denied more than 250% above the typical denial rate.

The Zillow study uses zip code-level Home Mortgage Disclosure Act data from 2017; there was insufficient zip code-level data for indigenous and native Alaskan applicants in DC.

See other articles related to: black homeownership, homeownership, homeownership rate, mortgage applications, mortgage discrimination, mortgages, racial equity

This article originally published at https://dc.urbanturf.com/articles/blog/black-mortgage-applicants-in-dc-denied-at-double-citywide-rate/17153.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro