What's Hot: The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

24 Percent of DC Homeowners Have Negative Equity

24 Percent of DC Homeowners Have Negative Equity

✉️ Want to forward this article? Click here.

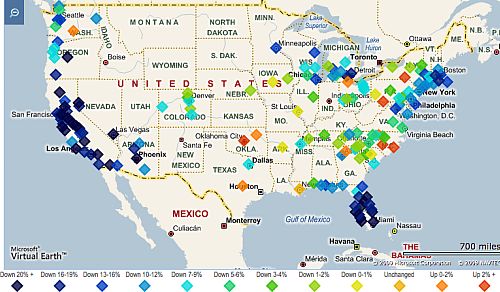

Zillow.com announced in a recently released report that one in five U.S. homeowners owes the bank more than their home is worth. The report also noted that 23.9 percent of homeowners in the DC area have negative equity.

The news of the large percentage of “underwater” borrowers was released just days after indications that dropping prices are making homes more affordable for first-time buyers. Despite that good news, it appears that homeowners who bought a property in the last couple years with a small down payment, have almost no equity in their homes.

Courtesy of Zillow

The Zillow Real Estate Market Report, which tracks 161 metropolitan statistical areas in the U.S., also showed that home values in the country dropped for the ninth consecutive quarter, declining 14.2 percent from a year ago, and falling 21.8 percent since the market peak in 2006.

For the full report, click here.

This article originally published at https://dc.urbanturf.com/articles/blog/24_percent_of_dc_homeowners_have_negative_equity/880.

Most Popular... This Week • Last 30 Days • Ever

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

The plan to replace the longtime home of Dance Loft on 14th Street with a mixed-use ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

Even with over 1,100 new apartments delivering in the last 18 months, the new develop... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

- One of DC's Oldest Homes Is Hitting the Market

- Plans For 101 Apartments, New Dance Loft On 14th Street To Be Delayed

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- The Nearly 2,000 Units Still In The Works At Buzzard Point

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro