Why A Fed Rate Cut In September May Not Send Mortgage Rates South

Why A Fed Rate Cut In September May Not Send Mortgage Rates South

✉️ Want to forward this article? Click here.

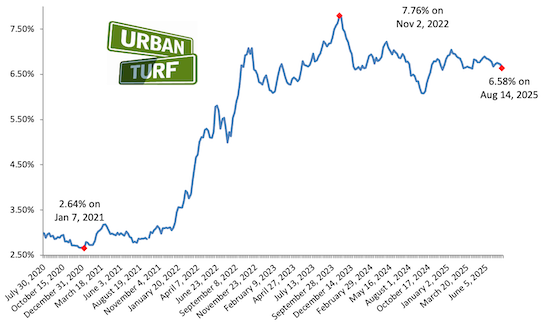

With anticipation that the Federal Reserve will cut interest rates in September, many homeowners, prospective buyers, and investors are hoping mortgage rates will follow suit and drop further. However, despite the Fed's expected decision, it is unlikely that mortgage rates will see significant declines. Below, we outline a few reasons why.

- Mortgage Rates Are Tied to Long-Term Bond Yields, Not Just Short-Term Rates

While the Federal Reserve sets the federal funds rate — a short-term interest rate that affects borrowing costs across the economy — mortgage rates are primarily determined by the bond market, particularly the 10-year U.S. Treasury yield, the benchmark for long-term interest rates.

If the Fed cuts rates, it signals a desire to support economic activity, but it doesn’t directly lower the long-term yields that drive mortgage rates. In fact, long-term bond yields may rise if investors interpret a Fed rate cut as a sign of economic trouble, which could lead to inflation concerns. In such cases, mortgage rates might not drop and could even rise, as bond investors demand higher returns to compensate for potential inflation.

- The Fed's Rate Cut May Be "Priced In"

Financial markets are forward-looking, meaning they often price in anticipated changes in the Fed’s policy long before the decision is actually made. Bond markets may have already adjusted for a September cut by lowering yields in anticipation of the Fed's move. This is called the "pricing-in" effect.

If market participants have already priced in the rate cut, the actual announcement of the Fed's decision may not have a significant impact on mortgage rates.

- Inflation Remains a Concern

One of the primary reasons mortgage rates have remained elevated in recent years is persistent inflation. Despite the Fed's interest rate hikes to combat inflation, core inflation remains stubbornly high, especially in sectors like housing and wages.

Even if the Fed cuts rates to stimulate economic growth, inflation concerns could keep mortgage rates from dropping significantly. Investors in the bond market are highly sensitive to inflation, and if they believe it is not under control, they may demand higher yields to compensate for the eroding value of fixed-income investments. This would put upward pressure on mortgage rates, even as the Fed cuts short-term rates.

- Economic Growth and Risk Sentiment Matter More Than the Fed’s Move

Mortgage rates also reflect the broader economic environment. If investors believe the Fed’s rate cut is a sign of economic weakness or a potential recession, they might be more cautious and demand higher yields on long-term bonds to offset the risk. In such an environment, mortgage rates could stay elevated, or even rise, as lenders and investors adjust their outlook on the economy.

Furthermore, mortgage lenders are often cautious in periods of economic uncertainty. If the Fed cuts rates in response to signs of a slowing economy, lenders may not immediately pass on the benefits of a rate cut to consumers, especially if they are concerned about the increased risk of default or reduced demand for housing.

- Global Factors Affect Mortgage Rates

Mortgage rates are not just influenced by domestic economic policy. Global events and trends, such as geopolitical instability, foreign demand for U.S. Treasury bonds, and shifts in global economic growth, also play a role. For instance, if foreign investors lose confidence in U.S. debt or if there's a flight to safety due to geopolitical concerns, Treasury yields (and by extension, mortgage rates) could rise.

The interconnectedness of global markets means that domestic rate cuts by the Fed might not have the expected direct effect on mortgage rates, especially if global conditions are pushing yields in the opposite direction.

In a market already shaped by high inflation, ongoing global uncertainty, and investor caution, the Federal Reserve cut may not move the needle on mortgage rates may remain elevated for the foreseeable future.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/why_the_fed_cutting_rates_in_september_may_not_send_mortgage_rates_south/23786.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro