Why Am I Seeing Different Rates For A 30-Year Mortgage?

Why Am I Seeing Different Rates For A 30-Year Mortgage?

✉️ Want to forward this article? Click here.

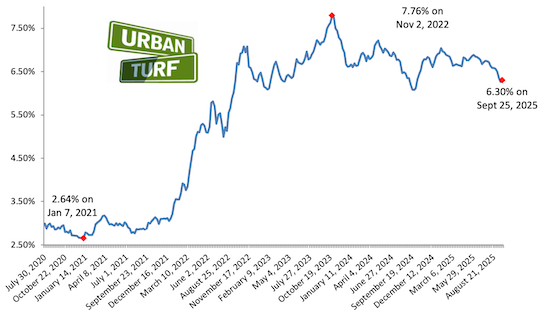

When it comes to home financing, homebuyers are drawn to the 30-year mortgage for its stability and predictable payment structure. However, if you've ever shopped for a mortgage, you might have noticed that the quotes for 30-year mortgage rates can vary significantly.

This variability can be confusing, but it stems from several key factors that influence mortgage pricing that UrbanTurf outlines below.

Lender Competition

The mortgage market is highly competitive, with a multitude of lenders vying for borrowers’ business. Each lender has its own set of criteria, risk assessments, and business strategies, which can lead to different rates. Some lenders may offer lower rates to attract more customers, while others may position themselves as premium providers with higher rates and additional services. This competitive landscape can lead to a range of quotes for the same loan product.

Borrower Qualifications

The rate you receive on a 30-year mortgage is heavily influenced by your financial profile. Factors such as credit score, debt-to-income ratio, employment history, and down payment amount all play a critical role in determining your mortgage rate. Lenders assess these factors to gauge the risk of lending to you. A borrower with a high credit score and low debt may qualify for better rates than someone with lower financial stability, leading to differing quotes based on borrower qualifications.

Loan Amount and Property Type

The size of the loan and the type of property can also impact mortgage rates. Lenders may have different pricing strategies for different loan amounts. For instance, conforming loans (which meet certain criteria set by government-sponsored entities) may have lower rates compared to jumbo loans, which exceed these limits and pose higher risks to lenders. Additionally, investment properties or second homes may incur higher rates compared to primary residences due to the perceived risk involved.

Economic Conditions

Mortgage rates are also influenced by economic factors, including inflation, interest rates set by the Federal Reserve, and market demand for mortgage-backed securities. When economic conditions fluctuate, lenders adjust their rates accordingly. For instance, in a rising interest rate environment, lenders might increase their rates to maintain profitability. This means that even in a short timeframe, rates can change significantly based on economic news and trends.

Rate Lock Options

Many lenders offer rate lock options, allowing borrowers to secure a specific rate for a set period, typically ranging from 30 to 90 days. However, not all lenders provide the same terms or flexibility regarding rate locks. If market rates drop after you lock in a rate, you might feel stuck; conversely, if rates rise, locking can be advantageous. This variability in rate lock policies can lead to different rate quotes among lenders.

Origination Fees and Points

Finally, it’s important to understand that mortgage rates are often quoted without accounting for fees and points. Some lenders may offer lower rates but charge higher origination fees or points (prepaid interest). Others might provide higher rates with fewer upfront costs. Comparing quotes should always involve looking at the annual percentage rate (APR), which includes both the interest rate and any associated fees, for a clearer picture of the total cost of the mortgage.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/why_am_i_seeing_different_rates_for_a_30-year_mortgage/22803.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro