What's Hot: Amazon To Close Down Fresh Grocery Stores

Trulia: Buying is 41 Percent Cheaper Than Renting in DC

Trulia: Buying is 41 Percent Cheaper Than Renting in DC

✉️ Want to forward this article? Click here.

Despite rising home prices, it is still cheaper to buy than to rent in DC (along with the 100 largest metros in the country), according to a report published today by Trulia.

In the DC area, buying is 41 percent cheaper than renting, while in the country as a whole, buying is 44 percent cheaper than renting. Last year, according to Trulia, buying was 46 percent cheaper than renting. But this advantage could close up next year, Trulia predicts: with prices rising faster than rents and mortgage rates moving up, the gap should narrow sharply by next year.

“Mortgage rates are likely to rise in the next year as the economy improves, even though they fell in the past year,” said Trulia’s Chief Economist Jed Kolko. “The consensus among macroeconomic forecasters is for 10-year Treasury bonds –which 30-year fixed-rate mortgages track pretty closely – to rise 6 or 7 tenths of a point over the next year. This translates roughly into a 7-9% higher monthly payment for a given mortgage.”

To determine their numbers, Trulia’s team compared the average rent and for-sale prices of an identical set of properties in each city. They considered the monthly costs associated with buying and renting and factored in one-time costs like downpayments and security deposits.

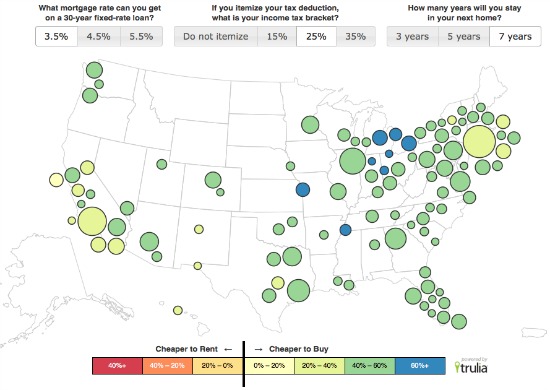

Trulia assumed that owners will have a 3.5 percent mortgage rate on a 30-year mortgage and will stay in their homes for seven years. However, they also created an interactive map to see how the numbers work with different assumptions. For example, if someone in the DC-area has 4.5 percent interest rate on their mortgage and plans on staying in their home for five years, buying is 26 percent cheaper than renting. With plans to move after three years, the advantage drops to five percent.

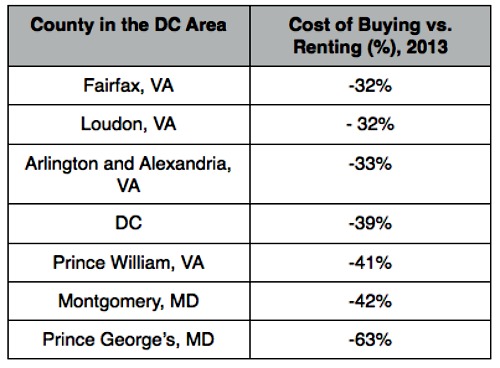

Trulia also sent us some DC-area specific stats, breaking down the region into the city proper and the surrounding counties. Check out the data below.

Note from Trulia: Negative numbers indicate that buying costs less than renting.

For Trulia’s full analysis, click here.

See other articles related to: housing prices, rent increase, rent vs buy, trulia

This article originally published at https://dc.urbanturf.com/articles/blog/trulia_buying_is_44_percent_cheaper_than_renting/6815.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

Navy Yard is one of the busiest development neighborhoods in DC.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro