Trulia: Buying is 34% Cheaper Than Renting in DC Area

Trulia: Buying is 34% Cheaper Than Renting in DC Area

✉️ Want to forward this article? Click here.

Despite rising home prices, it is still cheaper to buy than to rent in the DC area (along with the 100 largest metros in the country), according to a report published today by Trulia.

Trulia determined that buying is 34 percent cheaper than renting in the region, up from 31 percent in favor of buying back in September. However, the real estate site predicts that this gap will likely narrow with rising interest rates and home prices:

Some markets might tip in favor of renting this year as prices continue to rise faster than rents and if – as most economists expect – mortgage rates rise, due both to the strengthening economy and Fed tapering.

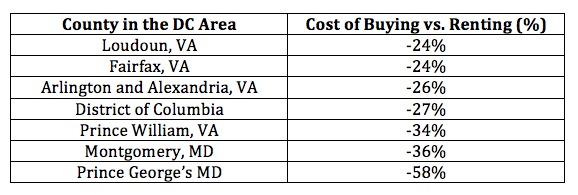

Trulia sent UrbanTurf some DC-area specific stats, breaking down the region into the city proper and the surrounding counties from a rent versus buy perspective. Check out the data below.

Note: Negative numbers indicate that buying costs less than renting.

Now with rent-versus-buy analyses, there are always questions about methodology, so Trulia has laid out the step-by-step path they used to come up with rent-vs-buy determinations in metro areas around the country.

In short, Trulia’s team compared the average rent and for-sale prices of an identical set of properties in each city, and then considered the present and future monthly costs associated with buying and renting and factored in one-time costs like down payments and security deposits.

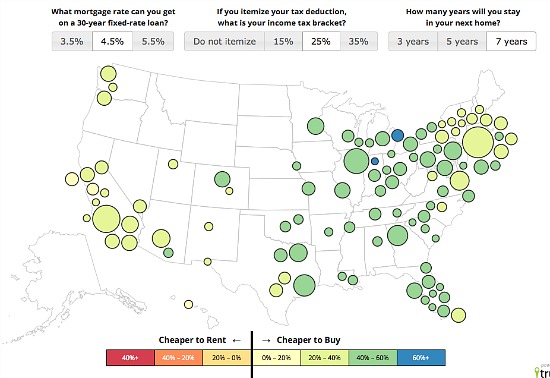

Trulia assumed that owners will have a 4.5 percent rate on a 30-year mortgage, put 20 percent down and will stay in their homes for seven years. However, they also created an interactive map to see how the numbers work with different assumptions. For example, if someone in the DC-area has a 4.7 percent interest rate on their mortgage, but plans on staying in their home for just five years, buying is 25 percent cheaper than renting. With plans to move after three years, the advantage of buying over renting drops off almost completely.

If you don’t agree with the assumptions, Trulia has unveiled their own rent-versus-buy calculator, so that users can play around with specific numbers.

The other thing that plays a huge role in this determination is home price appreciation and depreciation, which Trulia takes into account:

In our rent vs. buy calculations, we use a conservative annual home price assumption that ranges between 1.7% and 3.1%, depending on the metro. The reality, though, is that there’s a huge degree of uncertainty about what home prices will actually do, and the cost of buying relative to renting could turn out to be a lot higher or lower than with our conservative baseline appreciation assumption. To see how much uncertainty there is around what could happen to home prices, we calculated the annual home price appreciation for the best and worst seven-year periods over the past 20 years for each metro, using Federal Housing Finance Agency (FHFA) price data.

See other articles related to: rent vs buy, rent vs. buy, trulia, trulia trends

This article originally published at https://dc.urbanturf.com/articles/blog/trulia_buying_is_34_percent_cheaper_than_renting_in_dc_area/8170.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro