The True Cost and Profits of Condo Conversions in DC

The True Cost and Profits of Condo Conversions in DC

✉️ Want to forward this article? Click here.

Rendering by ARCADIA Design

A report published a few weeks ago that looked at the DC zip codes offering the greatest return on investment (ROI) for home flippers omitted a type of renovation prevalent in DC, specifically conversions of single-family homes into multiple condominium units.

To get a sense for the developer costs and ROI for these projects that have sprouted up on blocks all over DC, UrbanTurf spoke with a real estate consultant and a small-scale developer both of whom provided us with itemized expenses and profits for small condo projects they have been associated with.

story continues below

loading...story continues above

“North of Adams Morgan, Mount Pleasant, Columbia Heights, Howard [University] area, Eckington, all of these areas are decently safe places to invest for developers that are looking to do a condo conversion and that’s where we see most of our acquisitions,” Saman Zomorodi, a Condominium Conversion Associate at Standard Title Group and consultant who helps structure financing for real estate developers, explained.

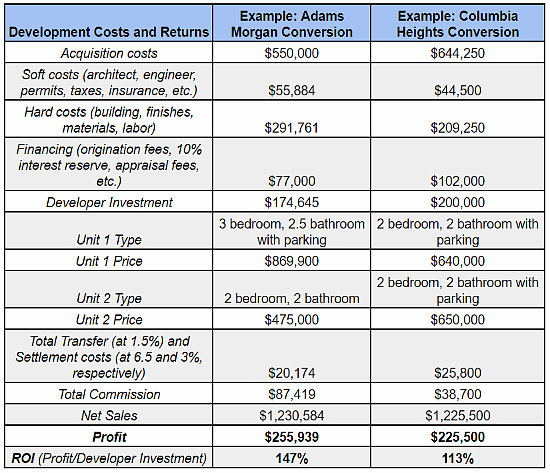

As the table below shows, once the actual costs that go into renovating and retrofitting a single-family home to sell it as two condos are calculated, developers in DC can enjoy healthy returns in zip codes that seemed less impressive for flipping in the report mentioned above, which noted that the highest ROI in DC came from zip codes East of the River. The table compares 14-month conversions in Adams Morgan and Columbia Heights, using data provided by Zomorodi and a developer who specializes in these sort of conversions and wishes to remain anonymous.

Costs and returns for single-family homes converted into two condo units

As the above data illustrates, both projects delivered healthy profits in excess of $220,000, before taxes, while also highlighting the variety of costs that developers incur. And while these developments were quite successful, the initial acquisition costs were low, which is becoming more and more rare in a city where there is so much competition and demand. Another thing to consider is that neither project was plagued by variables that can quickly eat into the profits for developments of this scale, such as unexpected construction costs or not achieving the original list price for the condos.

See other articles related to: condo conversion, conversions, flipping, house flipping

This article originally published at https://dc.urbanturf.com/articles/blog/the_true_cost_and_profits_of_a_condo_conversion_in_dc/12850.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro