What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

The New and Improved Rent v. Buy Calculator

The New and Improved Rent v. Buy Calculator

✉️ Want to forward this article? Click here.

Graphic from The New York Times.

On Thursday, The New York Times ran a series of articles about home buying, many of which highlighted the newspaper’s new and improved Rent vs. Buy calculator. The calculator was created several years ago by graphic editors Kevin Quealy and Archie Tse.

“It is an interactive calculator that uses formulas to calculate the year-by-year costs of buying and renting,” Kevin Quealy told UrbanTurf in 2010. “It then determines which is cheaper after each year.”

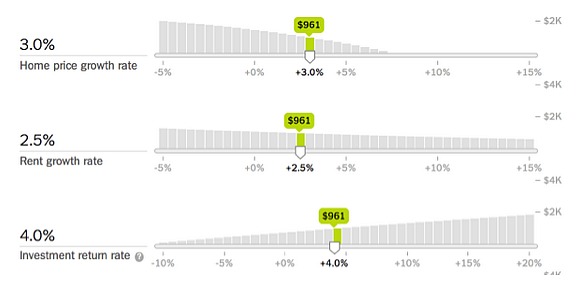

Here is how the calculator works. Users input their monthly rent and their desired home price point, in addition to a slew of variables like down payment amount, probable mortgage rate, property taxes, condo fees and the rate of home value appreciation and rent increases in their area. The calculator then creates a graphical representation of the time it takes for one to break even on their investment, and the return on that investment going forward. The calculator also lets you compare figures across a theoretical number of years lived in the property, so you can see the cumulative savings or loss.

The new version of the calculator operates the same way, but adds in some important new variables. Now, it allows users to include the annual ROI, the annual inflation rate and the marginal tax rate, and also makes it easier for users to change inputs. Mike Bostock and Shan Carter worked with Archie Tse on the new version.

“The most important new feature is probably the ability of users to dynamically change any of the inputs using a slider and immediately see how it changes their outcome,” Tse wrote to UrbanTurf. “I think it’s surprising to see how much a small change in your outlook on home price appreciation and rent rate increases effects the answer for you. We’ve also been having fun exploring how differences in mortgage rates can affect whether you should have a larger or smaller down payment.”

The one issue that remains with the calculator is that it does not allow you to enter a variable home price appreciation or rent increase percentage. In other words, if a user enters a home price appreciation rate of 5 percent a year, that level of appreciation is assumed for the entire period of the loan.

Also, there are a variety of non-financial intangibles that the calculator does not take into account. Economics reporter Neil Irwin has a great piece on those intangibles out today that frankly any prospective home buyer should read.

UrbanTurf has tested out the calculator at times over the last few years. For those interested in giving it their own test drive, click here.

This article originally published at https://dc.urbanturf.com/articles/blog/the_new_and_improved_rent_v._buy_calculator/8520.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro