What's Hot: Douglas Development Files PUD For Large Warehouse At New City Site Along New York Avenue

The DC Rental Affordability Mismatch

The DC Rental Affordability Mismatch

✉️ Want to forward this article? Click here.

DC Policy Center's latest rental report builds on prior analysis of the city's mismatched housing market.

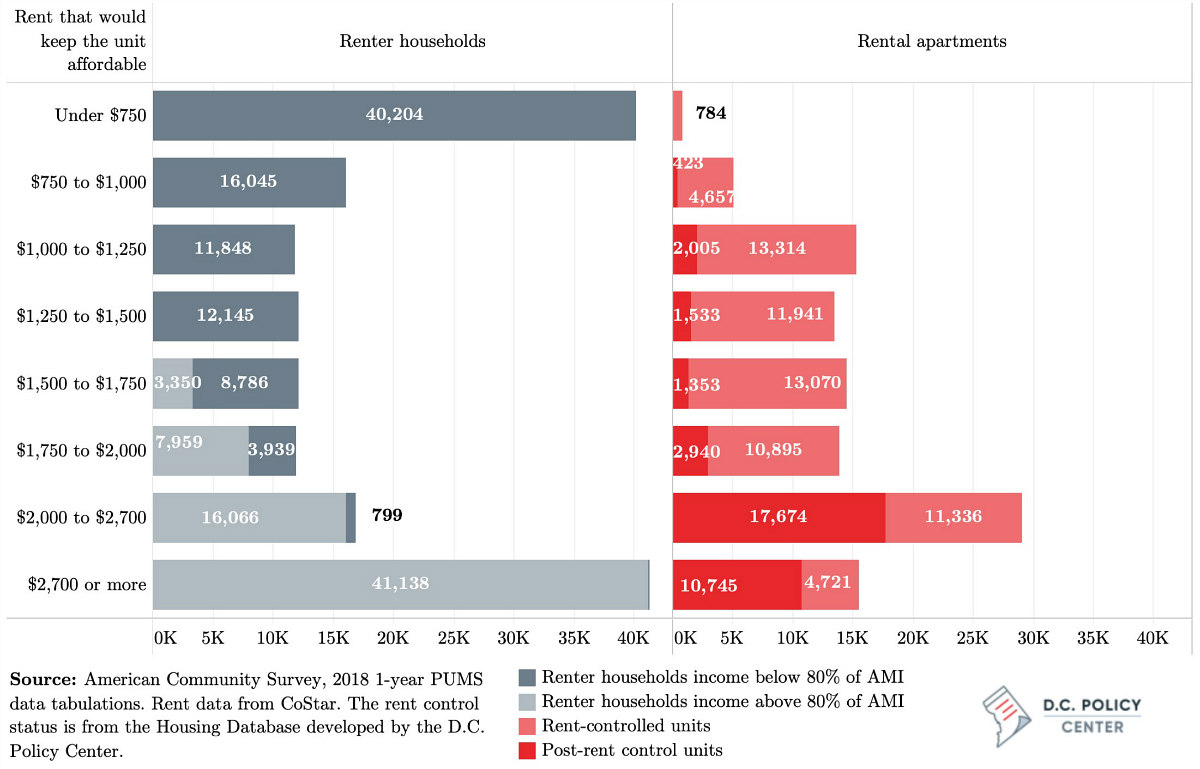

The report highlights how the scarcity of rentals for households at various income levels creates pressure throughout the rental market, as households at both the lowest and highest ends of the income spectrum face a supply shortage.

For example, the 40,200 renter households in DC that would need an apartment renting for $750 or less in order to pay an affordable (30% of income) rate for housing are competing for fewer than 800 units in apartment buildings. However, there are an additional 12,700 units at this rental rate on the shadow rental market (loosely-regulated condos and houses), most of which are in Wards 5, 7, and 8.

story continues below

loading...story continues above

At the other end of the spectrum, 41,100 city households could easily pay more than $2,700 per month for rent, although it is unclear the extent to which those households would actually opt to do so. The market provides just under 15,500 units in apartment buildings renting in this range, 4,700 of which are rent-controlled. Another 17,000 units rent for this price on the shadow market, most of which are in Wards 2, 3, and 6.

High competition for the most affordable units and limited options for the most expensive units has the effect of creating pressure on the rental market for the 43,000 households in the middle. Put another way, the approximately 71,400 one- and two-person households that cannot afford the median rent on the 75,730 studio and one-bedroom rental apartments on the market are competing with the 58,300 one- and two-person households that can.

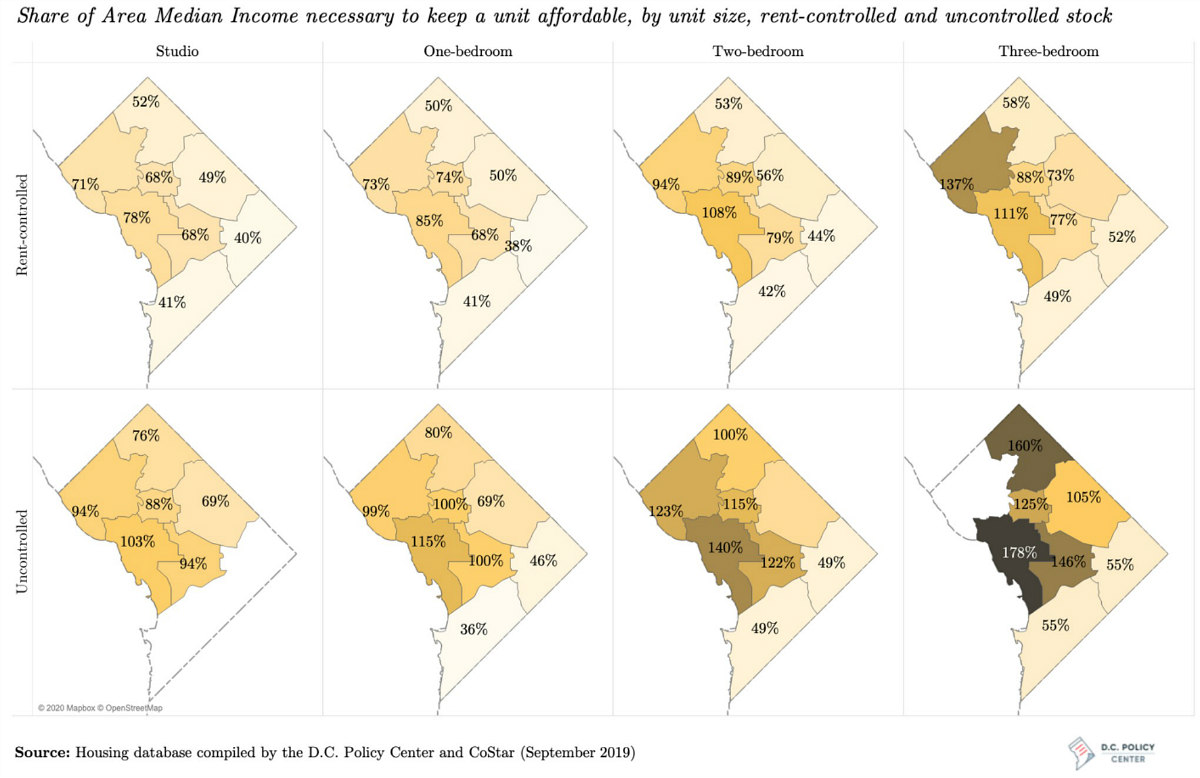

Meanwhile, the variation in rental rates around DC restricts households at certain income brackets to certain areas, even when rent-controlled units are factored in. In Ward 2, for example, a household would need to earn at least the area median income (AMI) to afford the typical two- or three-bedroom rent-controlled unit, or to afford a unit of any size not subject to rent control. Wards 7 and 8 are the only in the city where a household earning up to 60% of AMI can afford the typical unit that isn't subject to rent control.

*AMI estimates based on appropriate match between unit and household size; eg. studios assume one-person households, three-bedrooms assume four-person households, etc.

See other articles related to: affordability, affordable housing distribution, dc policy center, dcpc, rent affordability

This article originally published at https://dc.urbanturf.com/articles/blog/the-dc-rental-affordability-mismatch/16671.

Most Popular... This Week • Last 30 Days • Ever

When you buy a home in the District, you will have to pay property taxes along with y... read »

The largest condominium building in downtown DC in recent memory is currently under c... read »

The plan to convert a Dupont Circle office building into a residential development ap... read »

The Rivière includes just 20 homes located on the eastern banks of the Anacostia Riv... read »

Why Tyra Banks is serving ice cream in DC; a bike shop/record store opens in Adams Mo... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro