What's Hot: Douglas Development Files PUD For Large Warehouse At New City Site Along New York Avenue

The DC Area Has a Deficit of Over 200,000 Housing Units for Lowest Income Households

The DC Area Has a Deficit of Over 200,000 Housing Units for Lowest Income Households

✉️ Want to forward this article? Click here.

Over the past year, discussions have increased about how the DC area can address the local housing shortage, the housing affordability gap, and the question of how to ensure DC proper can handle a potential one million residents 25 years from now. The Urban Institute released a report on Wednesday which contextualizes these conversations with data illustrating just how far the region has to go to fulfill current and projected demand.

Below are three charts which shed some light on the housing shortage at each income level:

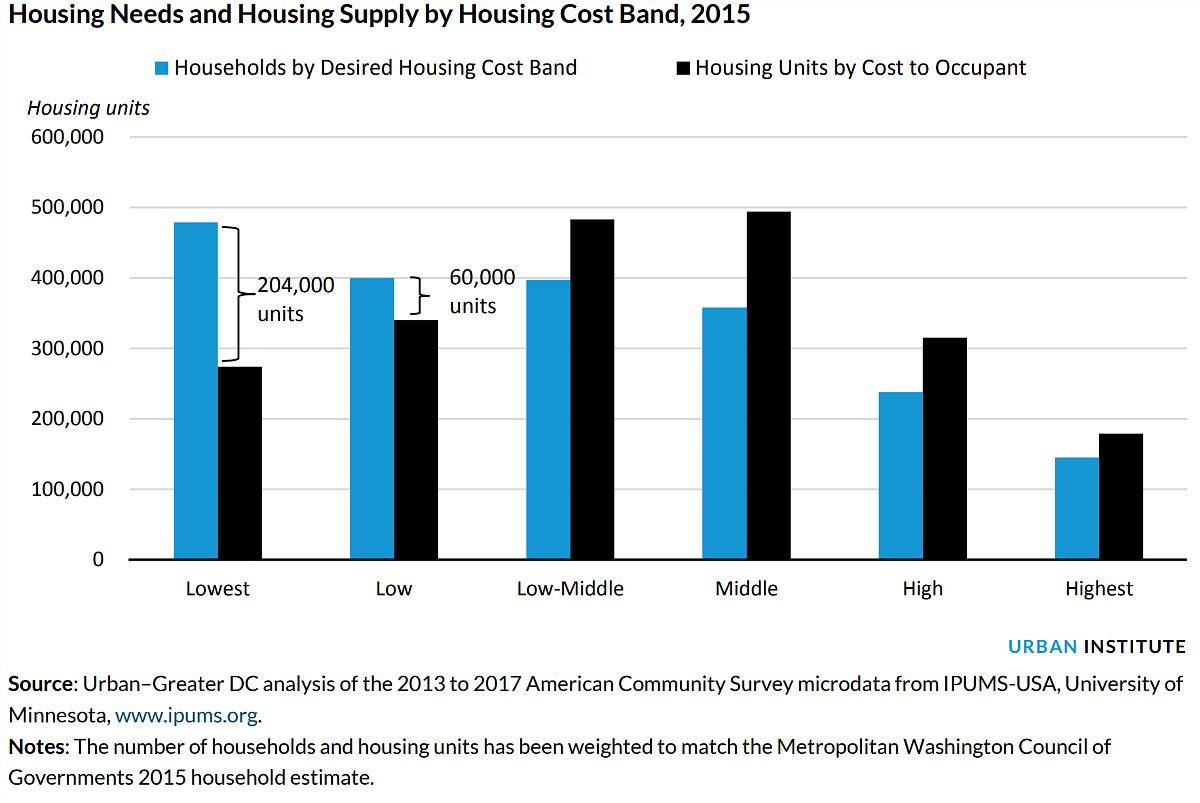

The table above compares the number of households at each income band with the number of housing units which would be affordable to households which can only afford the least expensive housing in that income band. Based on 2015 estimates, there is a deficit of 204,000 housing units for households earning less than $32,600 a year; for households earning between $32,600 and $54,300, there is a deficit of 60,000 housing units.

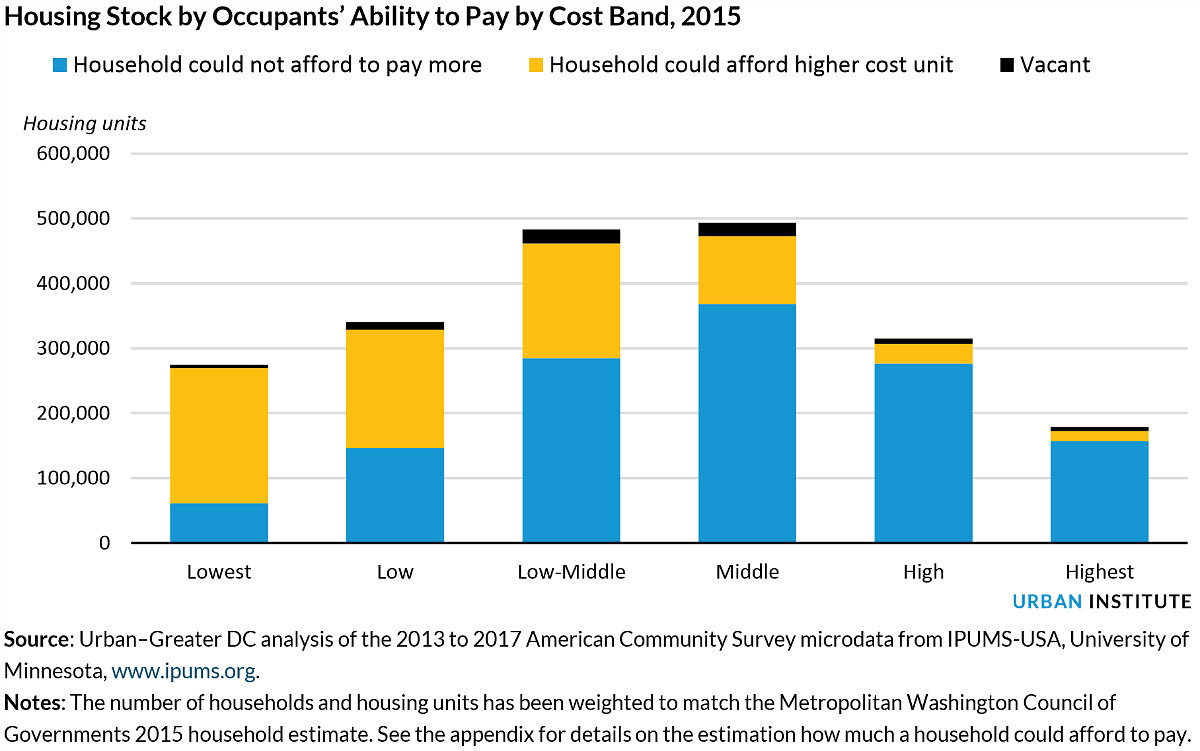

The dearth of supply amid the lower income bands leads to increased competition for the most affordable units in each income band, to the point that 75 percent of households in the lowest income band could afford a pricier unit. Similarly, more than half of households in the low income band, 37 percent of households in the low-middle income band (earning $54,300-$70,150), and 21 percent of households in the middle income band (earning $70,150-$130,320) could afford a pricier unit.

story continues below

loading...story continues above

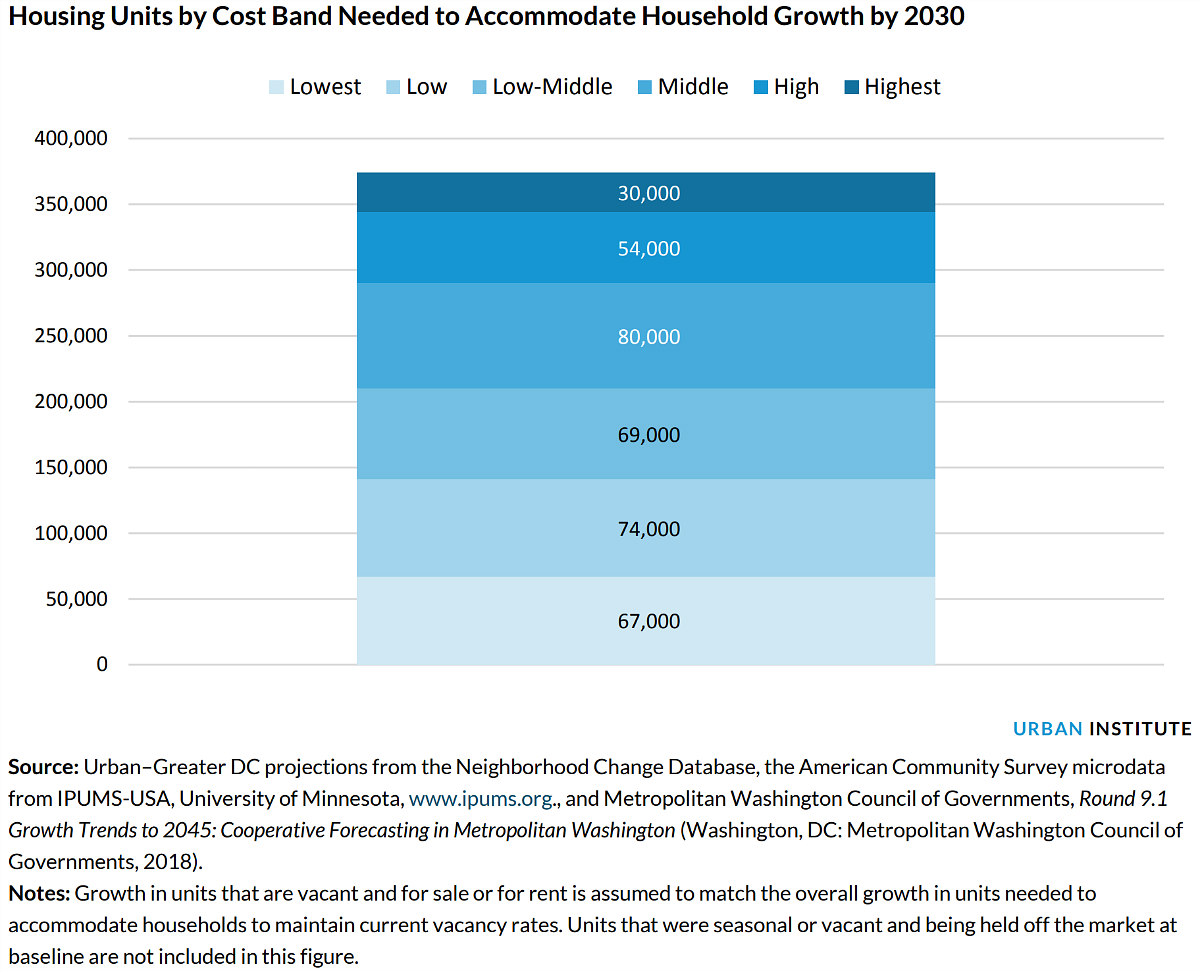

The report also calculates the number of housing units needed in order to create a more balanced and appropriate housing market in the DC area by 2030, by which time the region is expected to grow by 363,000 households. More than one-third of the new households will be lowest- or low-income earning, and more than half of the new units needed (210,000) should be affordable to households in the three lowest income bands. Roughly 141,000 of the units should rent for no more than $1,300 a month (in 2016 dollars).

The impending wave of retiring baby boomers is also expected to bolster the number of lower-income households. Currently, the Urban Institute counts 224,000 affordable rental units which will require intervention to maintain their affordability, whether because affordability covenants are expiring, or because they lack subsidies but are aging to the point that they could lose affordability through renovation or replacement.

The Urban Institute report uses data from the Metropolitan Washington Council of Governments as the baseline for its conclusions, and the region is considered to include DC proper; Prince George's, Montgomery, Charles and Frederick Counties in Maryland; and Arlington, Loudoun, Fairfax and Prince William Counties, plus Alexandria City, in Virginia.

See other articles related to: affordability, affordable housing, affordable housing dc, affordable housing distribution, construction, the urban institute, urban institute

This article originally published at https://dc.urbanturf.com/articles/blog/the-dc-area-has-a-deficit-of-over-200000-housing-units-for-lowest-income-ho/15836.

Most Popular... This Week • Last 30 Days • Ever

When you buy a home in the District, you will have to pay property taxes along with y... read »

The largest condominium building in downtown DC in recent memory is currently under c... read »

The plan to convert a Dupont Circle office building into a residential development ap... read »

The Rivière includes just 20 homes located on the eastern banks of the Anacostia Riv... read »

Why Tyra Banks is serving ice cream in DC; a bike shop/record store opens in Adams Mo... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro