What's Hot: Just Above 6%: Mortgage Rates Drop To 2022 Lows | Facebook Co-founder Lists DC Home For Sale

The 5 Percent New Grocery Store Rent Premium

The 5 Percent New Grocery Store Rent Premium

✉️ Want to forward this article? Click here.

A new study aims to dissect just how much of an amenity new grocery stores are based on the going rates of nearby apartments.

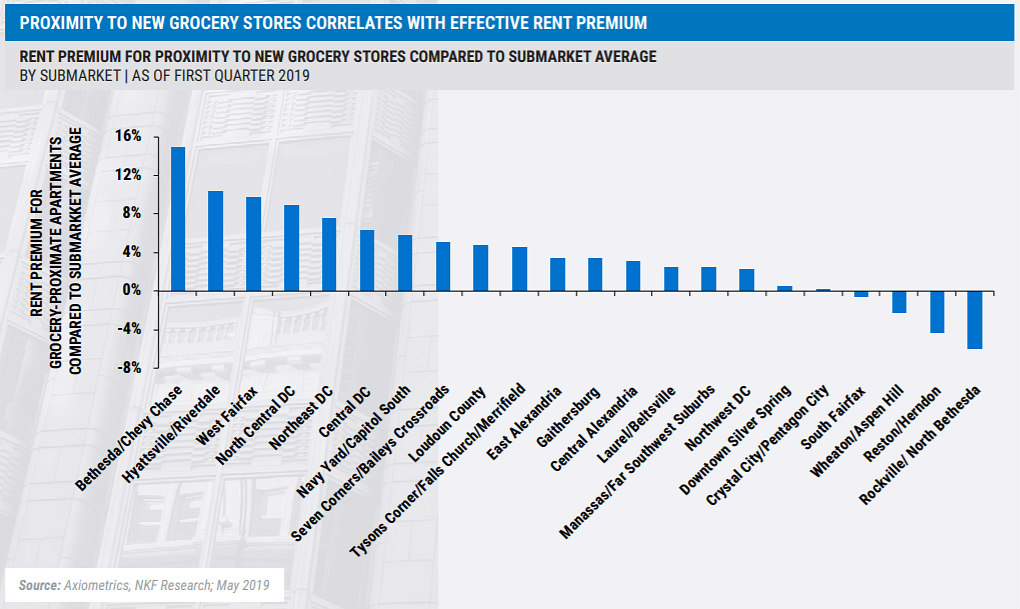

Citing the oft-observed "Whole Foods effect", whereby the presence of the grocer increases real estate values in the vicinity, Newmark Knight Frank has released an analysis of how the introduction of a new grocery stores raises rental rates in nearby apartments. The study looks at 42 grocery stores which opened in the DC area from 2014-2018, comparing the average effective rents within a half-mile of new stores in DC and within a mile of stores in DC's suburbs to the average effective rent across each submarket.

Across the region, there was a 5.1 percent rent premium observed within each ascribed radius at the time the grocery store opened. When comparing the 12 months prior to the 12 months following a store's opening, rent growth was 76 basis points higher within the radius than the 5-year average across the corresponding submarket.

The rent premium is most pronounced in DC proper, which accounted for seven of the 42 store openings studied. Rents within a half-mile of each store were 11.4 percent higher than the submarket average at the time of the store's opening; in the first quarter of 2019, the average rent within the radius was still 6.3 percent above average. The most dramatic example is the Giant which opened at Cathedral Commons on Wisconsin Avenue; the 3,444 apartments within the radius rented at rates 3.8 percent higher than the Northwest submarket at opening, and 2.3 percent higher than the submarket now.

story continues below

loading...story continues above

Thirteen of the 42 stores studied opened in suburban Maryland, where rental rates within a mile of the new store were 4.2 percent higher than the submarket at opening, and 2.3 percent higher than the submarket today. An extreme example is the opening of Safeway on East West Highway in 2016, as the 3,066 apartments within a mile had rental rates 19.2 percent higher at the time of opening, and 10 percent higher now, than those across the Hyattsville/Riverdale submarket. Compared to DC and northern Virginia, Suburban Maryland had the greatest difference in rent growth within the new store radii compared to the larger submarkets; however, the report also notes that this dynamic could also be due to grocery stores opening here less frequently than elsewhere.

With 22 of the 42 subject stores opening there, the rental premium was least pronounced in northern Virginia, a phenomenon which could be due to the fact that most of the rental units within a mile of a new grocery store were often within a mile of multiple new grocery stores.

The new grocery rental premium is most pronounced surrounding Whole Foods locations (an 8.4 percent premium at opening time, across 4 new stores), followed by Safeway (8.2 percent premium, 4 new stores) and Harris Teeter (7.9 percent premium, 8 new stores). Interestingly, Trader Joe's is the only grocer where the rent premium has increased since the time of new stores opening.

For the 12 grocery stores which anchored new apartment buildings, rents in the same building held a 23.4 percent rent premium above the submarket average within a year of opening and a 13.7 percent premium above other apartments within the ascribed radius. In the first quarter of 2019, these premiums were 16.1 and 9.7 percent, respectively.

It is important to note that for some stores, proximity to amenities could skew the rental premium comparisons. For example, the aforementioned Hyattsville Safeway is two blocks from the Prince George's Plaza Metro and the Mall at Prince George's. Another example is the North Central DC submarket, where a new store opening coincided with one of the highest rent premiums in the study (8.9 percent in the first quarter of 2019; 18.4 percent at the time of store opening); however, the only store which opened here during the window of this study was the redeveloped Safeway, anchoring a residential development one block from Georgia Avenue-Petworth Metro station.

It should also be noted that medians rather than averages are generally thought of as a better measure of variables like rent, in order to account for outliers. It is also worth noting that the methodology doesn't describe how the submarkets were identified.

See other articles related to: grocery stores, rental premium, renting in dc

This article originally published at https://dc.urbanturf.com/articles/blog/the-5-percent-new-grocery-store-proximity-rent-premium/15394.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro