Sponsored: Mortgages for Doctors

Sponsored: Mortgages for Doctors

✉️ Want to forward this article? Click here.

BB&T Home Mortgage specializes in providing loans that are custom-tailored to a borrower's needs. With that in mind, it is now offering specifically-designed financing for physicians looking to buy a home.

BB&T understands the mortgage needs of local physicians and is making the new loan product available to doctors in all stages of their careers—from medical interns, fellows and residents to licensed physicians who have completed their residency, internship or fellowship within the last 10 years.*

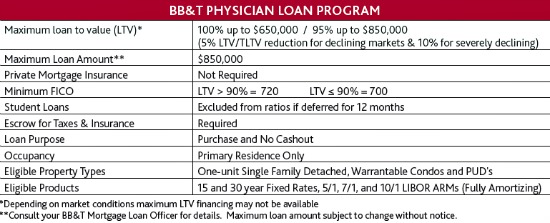

Borrowers who use the Physician's Loan can receive home loans up to $850,000. Depending on market conditions, the maximum loan-to-value ratio varies from 100% for loans up to $650,000 to 95% for loans up to $850,000. (Student loans are excluded from ratios if deferred for 12 months.) Eligible property types include one-unit single-family detached homes, warrantable condos and planned unit developments, but the property being purchased must be used as the borrower's primary residence.

Here is a nice snapshot of all the loan requirements and specifics, provided by BB&T Mortgage Loan Officer Matthew Rexrode:

The minimum down payment is affected by the property location. In DC, Arlington, Alexandria, BB&T can do 100% loans up to $650,000. But, if the appraiser notes that market values are declining, the minimum down payment would be 5%. In Montgomery County, the minimum down payment is usually 5%, but exceptions can be made.

For more information about the Physician's Loan in the DC area, click here or contact Matthew Rexrode at 703-841-5020 or via email at MRexrode@BBandT.com.

* The BB&T Physician Loan is available to doctors in the following schools of medicine: Medical (MD), Osteopathy (DO), Dental Surgery (DDS), Dental Medicine (DMD), Optometry (OD), Ophthalmology (MD), Podiatric Medicine (DP), Surgery (DCh), and Psychiatric Medicine (DPM).

See other articles related to: bb&t, mortgages for doctors, sponsored articles

This article originally published at https://dc.urbanturf.com/articles/blog/sponsored_mortgages_for_doctors/5201.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

The plan to replace the longtime home of Dance Loft on 14th Street with a mixed-use ... read »

Even with over 1,100 new apartments delivering in the last 18 months, the new develop... read »

This week’s Best New Listings includes a two-bedroom bungalow in Brookland and a to... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- One of DC's Oldest Homes Is Hitting the Market

- Plans For 101 Apartments, New Dance Loft On 14th Street To Be Delayed

- The Nearly 2,000 Units Still In The Works At Buzzard Point

- Best New Listings: The Two-Bedroom House Edition

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro