What Lower FHA Loan Premiums Mean For Home Buyers

What Lower FHA Loan Premiums Mean For Home Buyers

✉️ Want to forward this article? Click here.

The Federal Housing Administration (FHA) is kicking 2015 off with a bang: The agency this week announced substantial cuts to the annual insurance premiums on its loans.

The FHA will reduce its loan premiums by one half of a percent, from 1.35 percent per year to 0.85 percent. The lowered mortgage insurance rate should save more than two million borrowers $900 a year, on average, as well as prompt 250,000 first-time homebuyers to purchase over the next three years, according to a news release from Housing and Urban Development (HUD).

“This action will make homeownership more affordable for over two million Americans in the next three years,” HUD Secretary Julián Castro said in the release. “Since 2009, the Obama Administration has taken bold steps to reduce risks in the mortgage market and to protect consumers. These efforts have made it possible to take this prudent measure while also ensuring FHA remains on a positive financial trajectory.”

The changes have spurred debate about whether it’s economically sound to lessen restrictions for buyers purchasing homes with down payments as low as 3.5 percent. HUD says it can afford the difference and claims the move will stimulate the economy.

Borrowers who were in the process of financing an FHA loan can cancel and start over to take advantage of the lower rates, HUD announced on Friday.

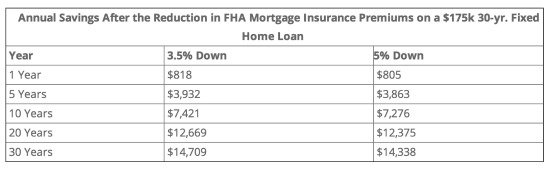

Zillow took a look at what the lowered premiums might mean for a borrower purchasing a $175,000 home. Here’s the breakdown:

Over the life of a 30-year mortgage, the move could save some borrowers almost $15,000. For higher priced homes, the savings would be notably higher.

This article originally published at https://dc.urbanturf.com/articles/blog/obama_administration_cuts_fha_loan_premiums/9387.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro