$26 Billion: The Numbers Don't Lie When It Comes to Taxation Without Representation in DC

$26 Billion: The Numbers Don't Lie When It Comes to Taxation Without Representation in DC

✉️ Want to forward this article? Click here.

Most DC residents tend to turn their attention to issues of autonomy and statehood more when April 15th rolls around. But just how much taxation and how little representation do DC residents endure?

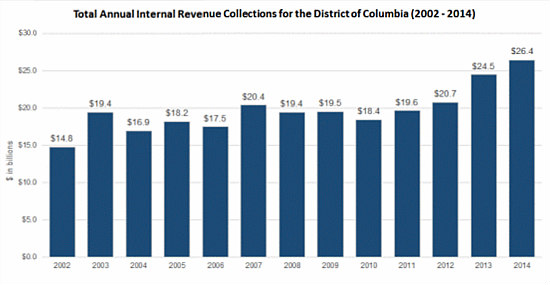

A recent post by District, Measured shows that in 2014, DC businesses and residents paid $26.4 billion in federal taxes — an 80 percent increase versus 2002 when the Internal Revenue Service stopped lumping our taxes with Maryland’s. From 2002 to 2014, DC residents paid the federal government $256 billion.

“In 2014 the District paid more federal taxes than 22 states and paid nearly the same amount as South Dakota, Alaska, Montana, Wyoming, and Vermont combined,” the District, Measured post stated. “Those states have 15 seats in Congress while the District has only one non-voting delegate.” And therein lies the rub.

story continues below

loading...story continues above

Although congressional representatives are not apportioned based on tax dollars, the fact remains that if DC did have a population-proportionate three representatives on the Hill, the city would have paid the fourth-highest tax dollars per representative in 2014. It’s no wonder that 67 percent of DC residents are pro-statehood.

The District, Measured’s analysis is based on numbers in the IRS Data Book.

See other articles related to: district measured, irs, representation, taxes

This article originally published at https://dc.urbanturf.com/articles/blog/numbers_dont_lie_taxation_without_representation_in_the_district/11149.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro