What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Mortgage Demand Pops As Rates Drop To Three-Month Lows

Mortgage Demand Pops As Rates Drop To Three-Month Lows

✉️ Want to forward this article? Click here.

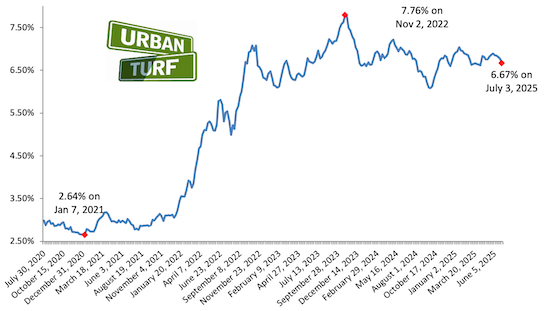

Long-term mortgage rates dropped to their lowest level in three months and homebuyers took notice.

Applications to purchase a home increased 9% week-over-week, and were 25% percent higher than a year ago, according to the Mortgage Bankers Association (MBA) on Wednesday. Applications to refinance also rose 9% for the week and were 56% higher than the same week one year ago.

“Homebuyer demand is being fueled by increasing housing inventory and moderating home-price growth,” said Joel Kan, vice president and deputy chief economist at the MBA, said in a release. “The average loan size on a purchase application, at $432,600, was at its lowest since January 2025.”

See other articles related to: mortgage demand

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_demand_pops_as_rates_drop_to_three-month_lows/23664.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro