What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

Mortgage Refinancing Demand Up Nearly 100% Over Last Year

Mortgage Refinancing Demand Up Nearly 100% Over Last Year

✉️ Want to forward this article? Click here.

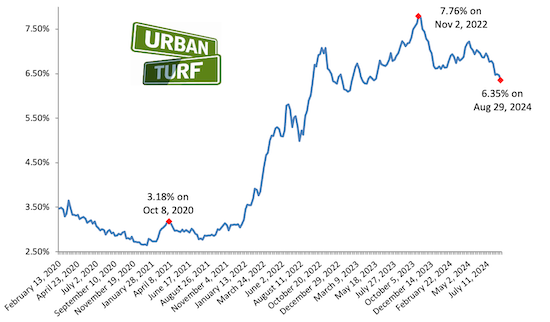

As interest rates fall, mortgage refinancing is on the rise.

Rates dropped for the fifth week in a row last week and total mortgage application volume rose 1.5%, the Mortgage Bankers Association (MBA) reported on Wednesday. Applications to purchase a home rose 3% but were 4% lower than the same week one year ago. Despite falling slightly compared week-over-week, refinancing demand was 94% higher than this time last year.

“Refinance applications were slightly down but continued to show strong annual gains as borrowers with higher rates have been refinancing to lower their monthly payments,” MBA economist Joel Kan said in a release. “The refinance share of applications averaged almost 46 percent in August, the highest monthly average since March 2022.”

See other articles related to: mortgage demand

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage-refinancing-demand-up-nearly-100-over-last-year/22674.

Most Popular... This Week • Last 30 Days • Ever

Rocket Companies is taking a page from the Super Bowl advertising playbook with a spl... read »

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

Column critique for Commanders stadium; more love for Eebees; and why just building m... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro