What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

Mortgage Rates Have Been Below 3% For 18 Weeks

Mortgage Rates Have Been Below 3% For 18 Weeks

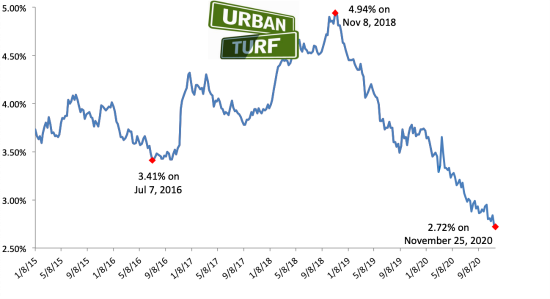

There was a time not long ago when it was unthinkable that long-term interest rates would drop below 3%. Now, it will be a little odd when they go back above that benchmark.

On Wednesday, rates remained at the record low of 2.72% set last week. Rates have now been below 3% for almost five months.

story continues below

loading...story continues above

“Mortgage rates remain at record lows and while that has fueled a refinance boom, it’s been driven mainly by higher income borrowers. With about 20 million borrowers eligible to refinance, lower- and middle-income borrowers are leaving money on the table by not taking advantage of low rates,” Freddie Mac's Sam Khater said in a release. “On the homebuying side, demand continues to surge, and it has created a seller’s market where inventory is at a record low and home prices are rising, beginning to offset the benefits of the low rates.”

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage-rates-have-been-below-3-for-18-weeks/17584.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

A new hotel has been pitched for a development site in Mount Vernon Triangle that has... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro