Is Now the Best Time to Buy in DC?

Is Now the Best Time to Buy in DC?

✉️ Want to forward this article? Click here.

It is a buyer’s market out there for home buyers, and the data is there to prove it in DC.

The median sales price for a home in DC in August 2007 was $460,000. One year later, it is just over $400,000. The average price per square foot for a home on the market in 2007 was $420. Today it is about $389. This week, Washington City Paper featured a home that is listed at twenty percent less than it was in 2006.

So, does all this mean that you should buy a home tomorrow?

“If it were me, I would buy now,” Catherine Jardine, Redfin’s DC market manager, told UrbanTurf. “I think most sellers are at the point where they are listing their homes at market price, so you don’t really see grossly overpriced homes these days.”

But this is not the only good news for buyers. Jardine noted that, for every nine out of ten deals, the sellers are paying the majority of the closing costs. And as our article from Monday noted, the payment of closing costs is just the beginning.

The DC government is offering incentives of its own. If you are a first-time buyer, the government will give you a $5,000 tax credit that doesn’t have to be repaid. Essentially, it is a no-strings attached gift of $5,000 toward the purchase of your home. It is available to buyers with modified adjusted gross incomes of up to $90,000, or $130,000 for couples filing jointly.

There is also a $7,500 Federal tax credit available for all first-time home buyers (not just those in DC), but by law you cannot take advantage of both the Federal credit and the $5,000 credit. The credit is available for those individuals with modified adjusted gross incomes up to $95,000 and couples with income of up to $170,000. It is good for homes closed on before July 1, 2009. The difference between this credit and the $5,000 credit from the DC government is that you need to pay it back starting the year after you receive it, and it needs to be repaid in full in 15 years. If you sell your home during that 15-year period, you are still required to pay the remaining balance. For those buying in DC proper, the $5,000 credit is probably the way to go; those buying in Virginia and Maryland would have to go with the Federal credit.

While the market does look enticing, there are still requirements that buyers should meet before diving in.

“If you have good credit, cash in the bank, and are going to be in DC for five years, it is as good a time as any to buy,” Keith Gibbons of DC Home and Condo Prices told UrbanTurf. “However, if your finances and job future are up in the air, you are going to have to sit it out for awhile.”

Gibbons, whose website is one of the best resources for data about the DC housing market, punctuated this comment with an analysis of what is needed to buy a condo in the District.

“The traditional rule of thumb is that one’s mortgage should not exceed 28 percent of their gross income, and that mortgage and other long term debt shouldn’t exceed 36 percent of gross income,” he said. “So, if you have an income of $133,000, your monthly mortgage shouldn’t exceed $3103 (28%) and your mortgage plus other debt shouldn’t exceed $4000 (36%). Assuming you put 10% down on a $400,000 property, have a $500 a month condo fee, and have about $750 in insurance fees, then you’ll be just under the $3103 figure for the 28% rule.” If you have other debts (car, student loan, credit cards) then the grand total should not top $4000.

The other thing, or perhaps misconception, that many buyers have is that current home listing prices are as negotiable as haggling with a merchant at the grand bazaar in Istanbul. Jardine noted that buyers are expecting to get great discounts on the original listing price when in fact the vast majority of homes have already been priced very competitively.

“I think the biggest challenge that we have with buyers is pricing,” she said. “They are asking for seven to eight percent below asking, and the listing agents are saying ‘Don’t even bother.’ They know that they priced the property competitively, and are not going to budge that much just because the perception is that the market isn’t doing well.”

See other articles related to: dclofts

This article originally published at https://dc.urbanturf.com/articles/blog/is_now_the_best_time_to_buy_in_dc/170.

Most Popular... This Week • Last 30 Days • Ever

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

An incredibly rare opportunity to own an extraordinary Maryland waterfront property, ... read »

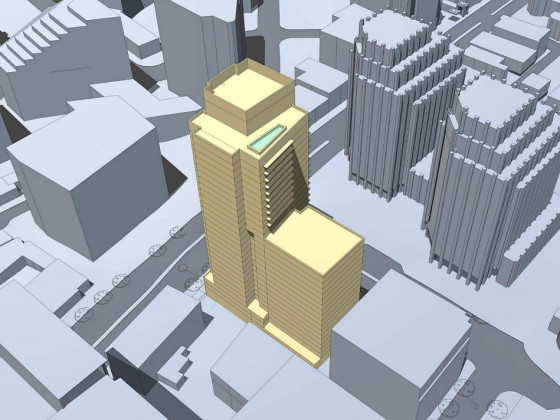

Georgetown is one of the busiest neighborhoods for development in the city.... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

- How Does The Mortgage Interest Deduction Work?

- 28 Acres, 1,500 Feet of Potomac River Waterfront: Sprawling Estate Hits The Market Just South of DC

- Hotels, Heating Plants & Conversions: The 10 Big Projects In The Works In Georgetown

- 29-Story, 420-Unit Development Pitched For Bethesda Moves Forward

- New Report Looks At Where Owners Are House Rich In DC

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro