How a Desire to Live in DC is Hindering Millennial Homeownership

How a Desire to Live in DC is Hindering Millennial Homeownership

✉️ Want to forward this article? Click here.

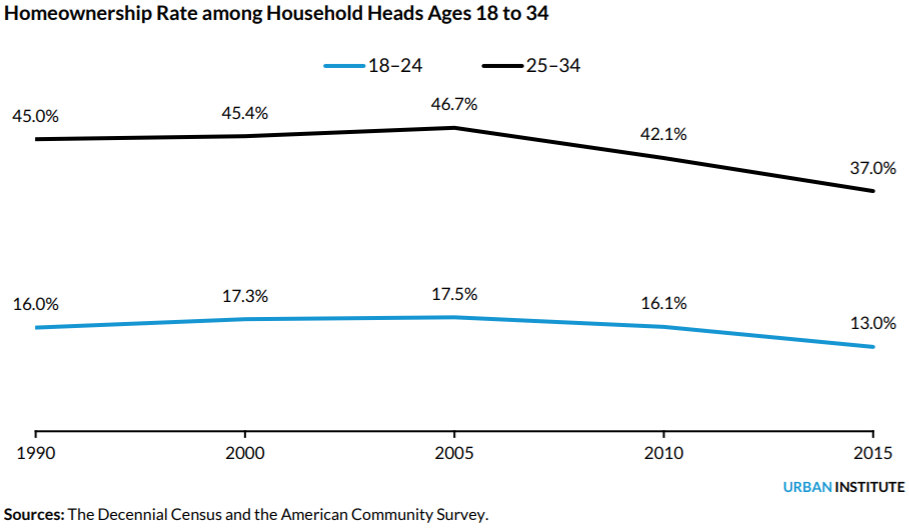

Earlier this week, UrbanTurf explored the conclusions of a new study from Urban Institute that examines why the millennial home ownership rate is lower than previous generations. Today, we take a look at the study's parsing of how millennials' preferences on where to live have contributed to these lower rates of homeownership, particularly in the DC area.

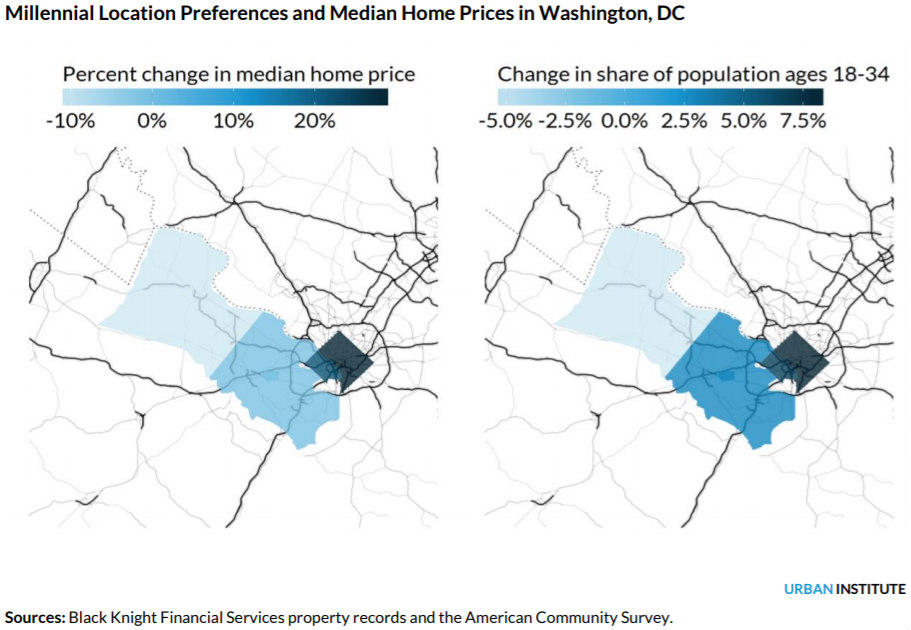

A major contributor to the lower homeownership rate among millennials with higher levels of educational attainment is a preference for living in urban areas, which often have an inelastic housing supply. This is particularly true in the DC area, where millennials' migration patterns have mirrored the shift in median home prices.

"In Loudoun County, a suburban county an hour outside the city center, the share of 18-to-34-year old residents decreased 5.8 percentage points, from 25.5 percent in 2005 to 19.7 percent in 2015," the report states. "The county saw median home prices decline from $499,900 to $441,000. In contrast, both DC proper and Arlington County, denser counties toward the city center, saw their 18-to-34-year-old population share increase 8.2 and 6.6 percent, respectively. In DC proper, the median home price rose 29 percent between 2005 and 2015, and in Arlington County, home prices rose 22 percent."

story continues below

loading...story continues above

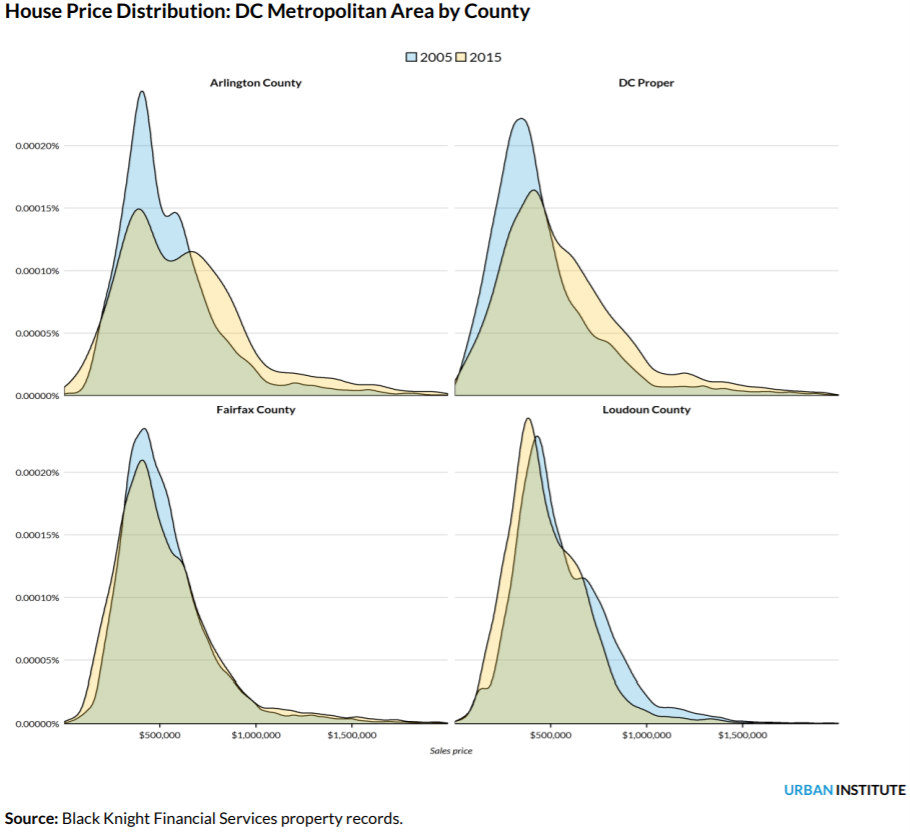

The above graphs illustrate that shift in the distribution of home prices, toward the seven-figure range in DC proper and Arlington County over the last decade, compared to a shift in the opposite direction in Loudoun County. Additionally, the lack of affordable housing for rent in city centers hinders millennials' ability to save up to make a down payment on a home purchase.

The recommendations Urban Institute offers to help increase the rate of homeownership among millennials would be beneficial to more than just millennials, including more lenient zoning that would increase the supply of affordable housing (a well-documented need in DC proper) and using rental payment history as a factor in determining credit-worthiness (a concept floated in DC Council, albeit only in reference to public housing residents).

See other articles related to: dc area home prices, dc home prices, homeownership, millennials, the urban institute, urban institute

This article originally published at https://dc.urbanturf.com/articles/blog/how-desiring-to-live-in-dc-is-hindering-millennial-homeownership/14223.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro