Home Prices Lose Momentum, But End 2013 Up 13.4 Percent

Home Prices Lose Momentum, But End 2013 Up 13.4 Percent

✉️ Want to forward this article? Click here.

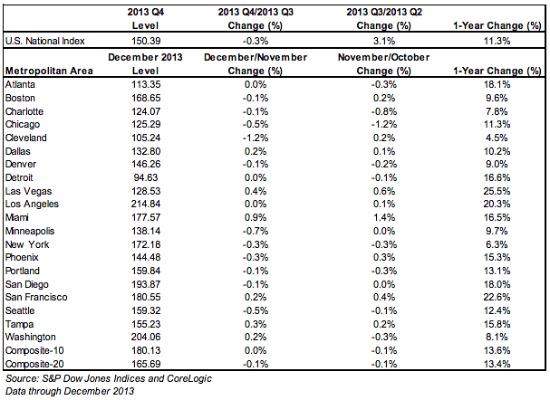

The S&P’s home price index finished up 2013 with its strongest showing since 2005, with prices up 13.4 percent at the end of the year. But signs are pointing to a slowdown, the latest Case-Schiller report released this morning indicated.

From the report:

“…gains are slowing from month-to-month and the strongest part of the recovery in home values may be over,” said David M. Blitzer, the S&P’s Index Committee chairman, in the news release. “Recent economic reports suggest a bleaker picture for housing. Existing home sales fell 5.1% in January from December to the slowest pace in over a year. Permits for new residential construction and housing starts were both down and below expectations. Some of the weakness reflects the cold weather in much of the country. However, higher home prices and mortgage rates are taking a toll on affordability. Mortgage default rates, as shown by the S&P/Experian Consumer Credit Default Index, are back to their pre-crisis levels but bank lending standards remain strict.”

Home prices didn’t perform very well nationwide in December, though the DC region was one of six metro areas in the country that posted gains, according to this morning’s report. Across cities, the average deceleration in home prices was much higher than the average improvement. Phoenix, which has been on top of the index for 26 months when it comes to price appreciation, saw a 0.3 percent drop in December, while Las Vegas, Los Angeles and San Francisco stayed on top of the index for 2013, each with gains of more than 20 percent for the year. Still, rates declined for December in all three of those cities, along with Atlanta, San Diego and Detroit.

The Case-Shiller Disclaimer

When considering the Case-Shiller findings, recall that the index is based on closed sales and home price data from several months ago. (A better indicator of where area prices stand right now in the region is the most recent report from RealEstate Business Intelligence.) Also important to note: The main index only covers single-family home prices, so co-op and condo prices are not included in the analysis that is widely reported. Chicago and New York City are two of the cities where Case-Shiller provides a separate index for condo prices, but DC does not have a similar index.

Lastly, and perhaps most importantly when considering the conclusions of the index, the area covered by Case-Shiller can only very loosely be described as the “DC area”. According to the site, the following cities are included: DC, Calvert MD, Charles MD, Frederick MD, Montgomery MD, Prince Georges MD, Alexandria City VA, Arlington VA, Clarke VA, Fairfax VA, Fairfax City VA, Falls Church City VA, Fauquier VA, Fredericksburg City VA, Loudoun VA, Manassas City VA, Manassas Park City VA, Prince William VA, Spotsylvania VA, Stafford VA, Warren VA, Jefferson WV.

See other articles related to: case-shiller, home prices, housing prices

This article originally published at https://dc.urbanturf.com/articles/blog/home_prices_lose_momentum_nationally/8165.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

One of the most ambitious federal housing proposals in years is moving through the le... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- What Is In The Big New Housing Bill?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro