What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

Half of DC Couples Filing Taxes Separately Had Large Income Disparities

Half of DC Couples Filing Taxes Separately Had Large Income Disparities

✉️ Want to forward this article? Click here.

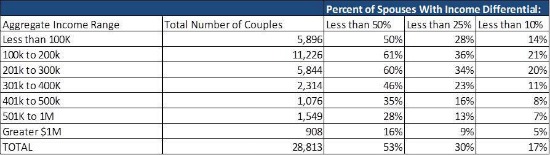

A large income gap exists for DC couples who choose to file taxes separately rather than jointly, according to a new post from the Office of Revenue Analysis blog District Measured. The blog found that about of DC couples filing separately had an income differential greater than 50 percent.

Couples who together earned between $100,000 and $350,000 a year had a less striking income differential, though the blog notes that 40 percent of people in that bracket still showed an income differential of 50 percent or more.

Here’s the rest of the data from the blog:

About 20 percent of couples earning between $100,000 and $300,000 a year had an income differential of 10 percent or less.

The data, taken from the 2012 personal income tax filings for DC couples who are married and filing separately, offers up a larger sample than the Census-run American Community Survey, according to District Measured. But it doesn’t include those couples who file jointly, which tends to include lower-income couples who may have even larger income differentials. (Couples often choose to file separately to avoid their combined incomes pushing them into a higher tax bracket.)

See other articles related to: district measured

This article originally published at https://dc.urbanturf.com/articles/blog/half_of_dc_couples_filing_separately_had_large_income_disparities/9854.

Most Popular... This Week • Last 30 Days • Ever

Only a few large developments are still in the works along 14th Street, a corridor th... read »

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro