FHFA Loan Limits Continue to Rise Above $1 Million in DC Region

FHFA Loan Limits Continue to Rise Above $1 Million in DC Region

✉️ Want to forward this article? Click here.

On Tuesday, the Federal Housing Finance Agency (FHFA) announced an increase to mortgage loan limits for next year, and in the DC region those limits continue to rise above $1 million.

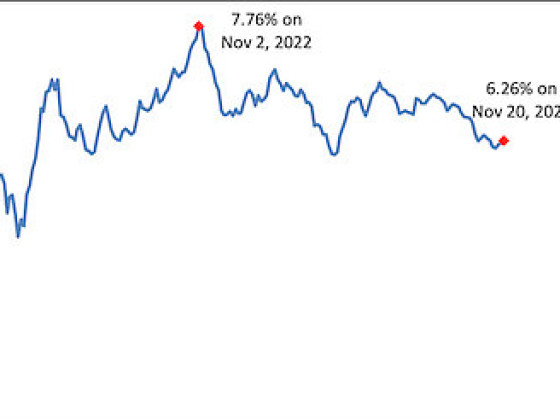

In 2024, Fannie Mae and Freddie Mac will be able to acquire mortgages of up to $766,500 for a single dwelling unit in the U.S., a 5.5% increase from the 2023 maximum of $726,200. The nationwide mortgage loan limit has increased by $350,000 since 2016, when it rose for the first time in a decade.

story continues below

loading...story continues above

The loan limits in the immediate DC area will be $1,149,825, up from $1,089,300 last year.

Government Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac guarantee many mortgages nationwide, often at lower costs and with more favorable lending terms. However, because they are legally bound to only accept loans of a certain amount, the increased loan limits make GSE loan underwriting more accessible to a larger pool of homebuyers.

See other articles related to: conforming loan limits, fhfa

This article originally published at https://dc.urbanturf.com/articles/blog/fhfa_loan_limits_continue_to_rise_above_1_million_in_dc_region/21729.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro