Could New FICO Rules Make it Harder for Homebuyers?

Could New FICO Rules Make it Harder for Homebuyers?

✉️ Want to forward this article? Click here.

As jurisdictions like DC are exploring ways to help people raise their credit scores, changes at a major credit scoring agency are expected to have the opposite effect.

FICO is going to be more aggressive in penalizing consumers who are delinquent in payments or who take on more debt, particularly via personal loans, The Wall Street Journal reports. The new calculation method is expected to raise the scores of consumers who already have a FICO score of 680 or above and maintain a good record of credit management, while lowering the scores of consumers with a FICO score below 600.

In one new scoring method, called "FICO 10 T", consumers who have missed payments in recent months will see their scores drop, while consumers who may have been delinquent a year or more ago could see their scores rise. The overall calculation will assess consumers' longer-term relationship to debt, looking at a trend over the past few years rather than the past few months to place more scrutiny on consumers whose overall debt is rising or whose utilization rate is consistently high.

The change could reverse the effect of more consumer-friendly practices that have been in effect in recent years, when FICO and other scoring and reporting companies began taking on-time bill payment and bank account balances into account. Between this and the removal of negative marks from credit reports after seven years, average FICO scores had been trending upward.

For some lenders, the changes are a welcome way to ascertain the creditworthiness of consumer applicants, particularly because of record-high consumer debt. However, this could have the effect of making it harder for some prospective homebuyers to secure mortgages, as Fannie Mae and Freddie Mac both rely on a type of FICO score.

See other articles related to: credit score, fico score, homebuying, mortgage lending

This article originally published at https://dc.urbanturf.com/articles/blog/could-new-fico-scoring-rules-make-it-harder-for-homebuyers/16370.

Most Popular... This Week • Last 30 Days • Ever

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

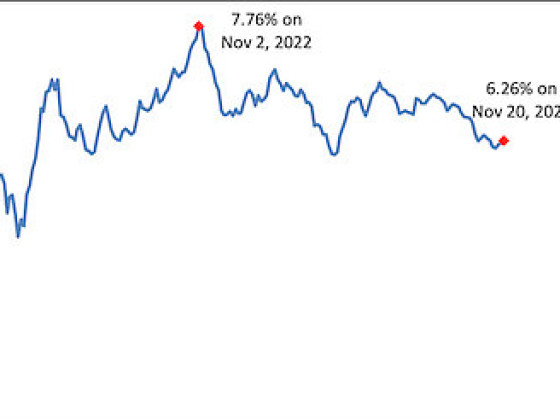

The DC-area housing market hit a sluggish patch in November, according to the latest ... read »

Chevy Chase apartment building sells at foreclosure auction; living in a storage unit... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro