What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Community Bank Offers 3% Down, No Mortgage Insurance

Community Bank Offers 3% Down, No Mortgage Insurance

✉️ Want to forward this article? Click here.

With housing costs in greater Washington continuing to climb, homeownership may seem like a distant dream for many Washingtonians. However, Sandy Spring Bank has taken steps to make home ownership more affordable.

Our Welcome Home Mortgage is a great alternative to an FHA or conventional loan, because the program does not require mortgage insurance. Taking into consideration the realities of the local market, a Welcome Home Mortgage is one of the few loan programs that provides up to 97% financing for loan amounts as high as $625,500.

Sandy Spring Bank is committed to building strong communities and helping people reach their homeownership goals. In addition to the Welcome Home Mortgage, Sandy Spring Bank can extend special terms to First-Time Home-Buyers or Civil Service employees.

The Welcome Home Mortgage features:

- 97% Financing to $625,500.00

- 3% down payment

- Purchases, or Rate and Term Refinances for up to 100% of the property’s appraised value

- 30 Year Fixed1 Terms or Adjustable Rate Mortgages2

- Loan to value up to 105% in combination with a down payment assistance program

- Seller contributions allowed up to 6% of the purchase price of the home

- Home Buyer Education is required

- The Welcome Home Mortgage is available to applicants with incomes below 80% of the area median income. In addition, the program is also available to all home buyers acquiring a primary residence in a low- or moderate-income area.

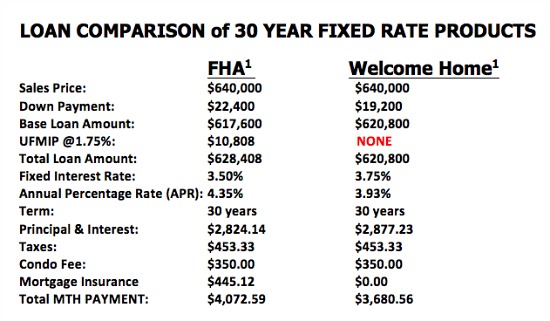

Take a look at the side-by-side comparison of the Welcome Home Mortgage to an FHA Loan for the purchase of a condo in Washington, DC. The Welcome Home Mortgage saves a home buyer $303.35 monthly. In addition, a home buyer receives a cost savings of $10,808 since Up-Front FHA Mortgage Insurance (UFMIP) would not be required.

For more information, contact Mortgage Banker Noel Shepherd, NMLS #313280, at 301-617-4245 or nshepherd@SandySpringBank.com.

While the fixed interest rate for the FHA loan is nominally lower, its APR, once monthly mortgage insurance is accounted for, is higher than the APR for the Welcome Home loan (4.35% vs. 3.93%). Taxes, insurance and condo fees are estimates based on a sales price of $640,000. Actual fees will vary. The Annual Percentage Rate (APR) is a measure of the cost of credit, expressed as a yearly rate.

1 Rates as of 4/13/2015. Rates quoted are for 1-4 family, owner occupied residences. Rates and terms subject to change without notice. APR shown may vary from final APR based upon borrower’s qualifications and loan program selected. Monthly payments examples are estimates only and may vary. Adequate property insurance is required. Flood Insurance will be required if the property lies in a Special Flood Hazard Area. 2 The Welcome Home Mortgage also has variable-rate programs available. Please contact a Sandy Spring mortgage banker for details.Offer available for new applications only. This special loan program and terms are available in select communities. Please consult a Sandy Spring Bank mortgage banker for specific loan programs and details.

This article originally published at https://dc.urbanturf.com/articles/blog/community_bank_offering_3_down_no_mortgage_insurance/9786.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro