An Interest Rate Cut Is Coming, But Does That Mean Lower Mortgage Rates?

An Interest Rate Cut Is Coming, But Does That Mean Lower Mortgage Rates?

✉️ Want to forward this article? Click here.

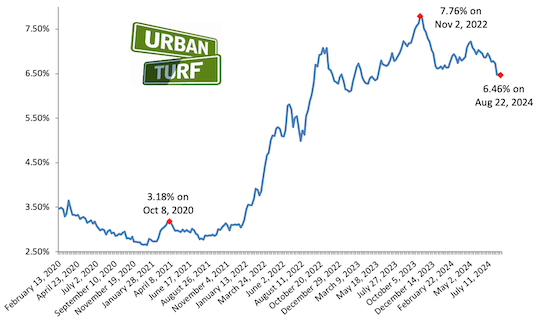

As expected this morning, Federal Reserve Chair Jerome Powell indicated that interest rate cuts are coming soon, perhaps as early as next month. This expected rate cut would likely result in lower mortgage rates, a move that both homebuyers and sellers would welcome. Today, UrbanTurf takes a look at why an interest rate cut would affect mortgage rates, and how far we can expect rates to drop.

Understanding the Federal Reserve’s Role

The Federal Reserve plays a crucial role in influencing interest rates through its monetary policy decisions. One of the primary tools the Fed uses to steer the economy is the adjustment of the federal funds rate, which affects borrowing costs across the economy. When the Fed cuts rates, it aims to stimulate economic activity by making borrowing cheaper, which can lead to increased consumer spending and investment.

How a Rate Cut Impacts Mortgage Rates

Mortgage rates are indirectly influenced by the federal funds rate. While the Fed’s rate cuts don’t directly alter mortgage rates, they create a ripple effect through financial markets. Here’s how:

-

Cost of Borrowing: A reduction in the federal funds rate generally lowers the cost of borrowing for banks and lenders. This can translate into lower interest rates for consumers, including those seeking mortgages. As banks face lower costs for short-term borrowing, they may pass these savings on to borrowers by offering lower mortgage rates.

-

Bond Yields: Mortgage rates are closely tied to yields on 10-year Treasury notes and other government securities. When the Fed cuts rates, it can lead to a decline in bond yields. As bond yields fall, mortgage rates often follow suit. Investors seeking better returns might shift their portfolios, influencing mortgage rates indirectly.

-

Market Sentiment: Rate cuts can also impact market sentiment and investor behavior. Lower rates may boost confidence in the housing market, potentially increasing demand for homes. Increased demand can put downward pressure on mortgage rates as lenders compete to attract borrowers.

Considerations and Cautions

While a rate cut can often lead to a drop in mortgage rates, that is not always the case. Here's why.

-

Rate Timing: Mortgage rates can be influenced by a variety of factors beyond the Fed’s decisions. Market conditions, economic data, and geopolitical events can all affect rates.

-

Lender Variability: Not all lenders react to Fed rate cuts in the same way. The actual mortgage rate offered can vary based on a lender’s business model, risk assessment, and market conditions.

Today's announcement will likely result in mortgage rates dropping throughout the rest of the year, but perhaps not as much as consumers would like. Long term rates have already fallen in the past several weeks, likely in anticipation of this morning's announcement.

Stay tuned to UrbanTurf for relevant mortgage rate news going forward.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/an_interest_rate_cut_is_coming_but_does_that_mean_lower_mortgage_rates/22636.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro