What's Hot: Barnes and Noble Returns To Georgetown Next Week | How An Unmarried Couple Buys A Home Together

A Guide to Flood Insurance in the DC Area

A Guide to Flood Insurance in the DC Area

✉️ Want to forward this article? Click here.

This article originally ran on UrbanTurf in May 2018.

The District's location along two rivers and their confluence practically makes flooding a certainty. Given that, UrbanTurf explains in this article how DC-area residents can go about securing flood insurance.

Most homeowners' and renters' insurance policies do not cover flooding. The largest flood insurance policy provider is the federal government, via the National Flood Insurance Program (NFIP), and insurance companies are middle-men for NFIP policies. This is the case in DC and throughout most of Maryland and Virginia.

story continues below

loading...story continues above

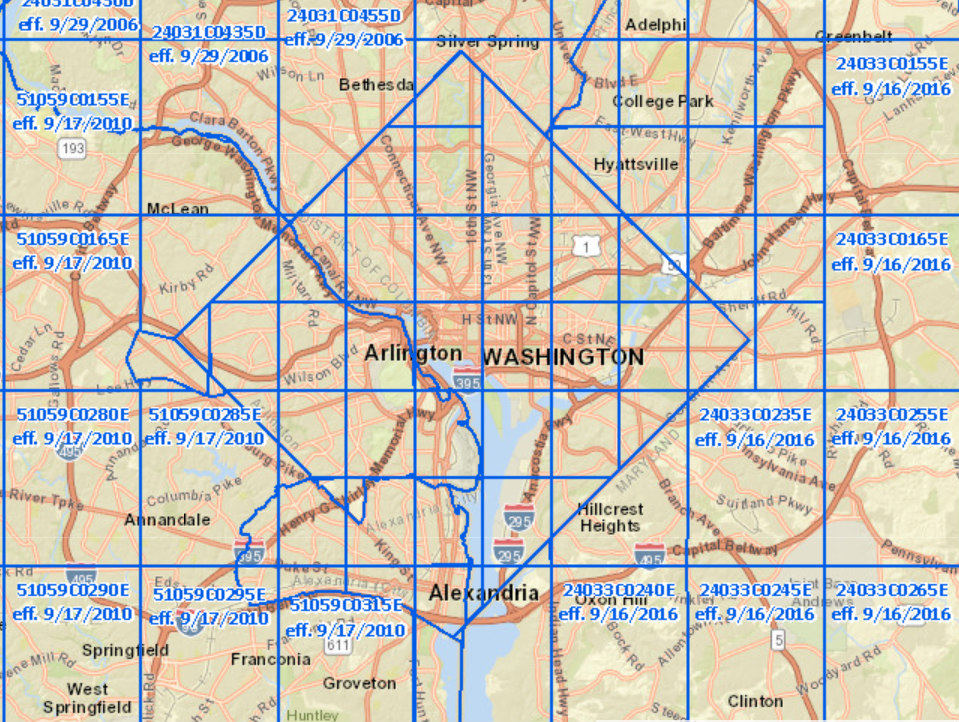

The NFIP calculates your flood insurance premium based on a variety of factors, the most important being a property's proximity to the floodplain. Premiums are standardized across providers and are determined by Federal Emergency Management Agency's (FEMA) Flood Insurance Rate Map.

Properties in high-risk flood areas, within the 100-year floodplain, require flood insurance of all mortgagees; in areas of low-to-moderate risk, or if a mortgage doesn't apply, such insurance is optional. Those who purchase insurance in optional zones can secure Preferred Risk Policies with lower premiums.

One can purchase a General Property Policy, which can cover five or more residential or non-residential buildings; a Residential Condominium Building Association Policy, which covers condos and townhouses; or a Standard Flood Insurance Policy, which is most commonly utilized and covers up to four individual units in multi-family buildings and single-family homes. The latter category offers either building property coverage of up to $250,000 or personal property coverage of up to $100,000; one can also purchase both.

Personal property policies can carry premiums as low as $60; one can opt to cover either the replacement cost of belongings or the actual cost of belongings factoring in depreciation. On average, annual premiums for plans with building coverage tend to be in the $400-$500 range. Contact your preferred insurance provider for a quote — and be sure to look up whether your home is in a high-risk area.

See other articles related to: flood insurance in dc, flood risk, flood zone, flooding, flooding in dc, floodplain

This article originally published at https://dc.urbanturf.com/articles/blog/a-guide-to-flood-insurance-in-the-dc-area/18658.

Most Popular... This Week • Last 30 Days • Ever

Estate taxes, also known as inheritance taxes or death duties, are taxes imposed on t... read »

In this article, UrbanTurf will explore the considerations and steps involved in buyi... read »

The most expensive home to sell in the DC region in years closed on Halloween for an ... read »

Paradigm Development Company has plans in the works to build a 12-story, 110-unit con... read »

The map and text amendment applications that were filed with the Commission last Octo... read »

- What Are Estate Taxes and How Do They Work?

- How An Unmarried Couple Buys a Home Together

- The Cliffs in McLean Sells For $25.5 Million, Highest Home Sale In DC Area In Years

- 110-Unit Condo Project Planned in Alexandria Coming Into Focus

- The Zones That Could Lead To More Development in Chevy Chase Set To Go Before Zoning Commission

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro