4.5 Years is Breakeven Horizon For DC Area Homeowners

4.5 Years is Breakeven Horizon For DC Area Homeowners

✉️ Want to forward this article? Click here.

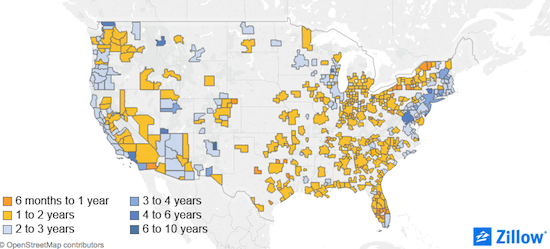

Area residents considering buying a home may be better off renting if they’re not planning to stick around for close to five years, according to Zillow’s latest breakeven research. The real estate site found that residents “would have to live in a home [for 4.5 years] before buying it would become more financially advantageous than renting it.” The national breakeven average is just below two years.

story continues below

loading...story continues above

Zillow’s breakeven point is the time at which the initial costs of purchasing a home and its investment value outweigh the ongoing costs of renting. Zillow uses a number of factors in its breakeven horizon, including price and rent projections, maintenance costs, transaction costs and tax deductability. It assumes that buyers will put down 20 percent of the sales price.

Chevy Chase Village, a section of the tony Maryland suburb where homes regularly sell for millions of dollars, had the longest breakeven horizon at 31 years, more than double the Somerset neighborhood, where renters would need 15 years to balance the cost of purchasing. Seat Pleasant had the lowest breakeven horizon of 1.3 years.

See other articles related to: breakeven horizon, chevy chase, zillow

This article originally published at https://dc.urbanturf.com/articles/blog/4.5_years_is_breakeven_horizon_for_dc_area_homeowners/10109.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro