4.32%: Mortage Rates Hit 2011 Low Again

4.32%: Mortage Rates Hit 2011 Low Again

✉️ Want to forward this article? Click here.

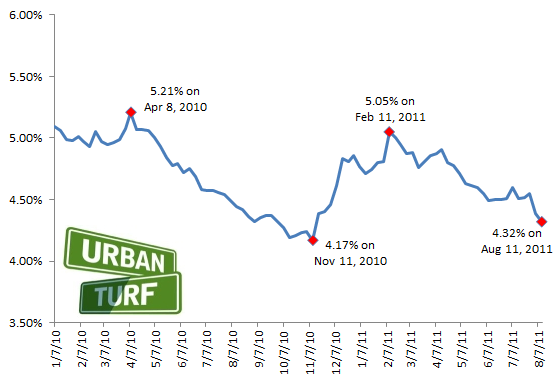

For the second week in a row, long-term mortgage rates dropped to a new low for 2011, as Freddie Mac reported that the average on a 30-year fixed-rate mortgage decreased to 4.32 percent with 0.7 of a point, down from 4.39 percent last week. Last year at this time, the long-term rate averaged 4.44 percent.

From Freddie Mac vice president and chief economist Frank Nothaft:

“Renewed market concerns about the European debt markets led investors to shift funds into U.S. Treasuries, pushing long-term yields lower. Further, in its August 9th Federal Open Market Committee statement, the Federal Reserve noted that economic growth so far this year had been considerably slower than it expected and that overall labor market conditions had deteriorated in recent months, leading the Committee to conclude that an exceptionally low federal funds rate should be maintained at least through mid-2013. These developments helped to ease mortgage rates lower this week.”

While news of slowing economic growth is not good, the low interest rates are putting home ownership affordability at an all-time high. The Freddie Mac press release noted that the National Association of Realtors® reported that its affordability index over the past three quarters has indicated the highest affordability since it was created in 1970.

Here’s a look at the path of rates since last January:

This article originally published at https://dc.urbanturf.com/articles/blog/4.32_mortage_rates_hit_2011_low_again/3963.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro