What's Hot: 110-Unit Condo Project Planned in Alexandria Coming Into Focus | DC's Most Anticipated Restaurant To Open Its Doors

2.96 Years: The Breakeven Horizon For DC-Area Homeowners Gets Shorter

2.96 Years: The Breakeven Horizon For DC-Area Homeowners Gets Shorter

✉️ Want to forward this article? Click here.

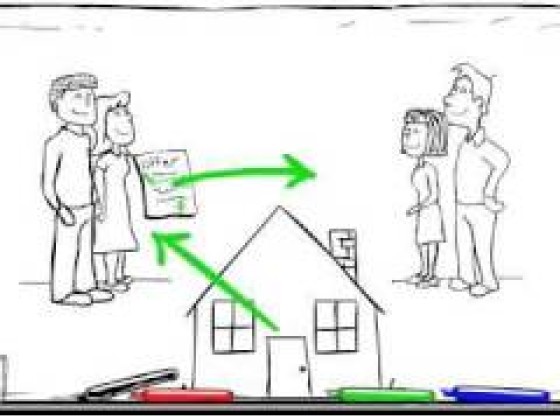

As both home values and rents rise, how long the DC region’s homeowners need to stay in their homes in order to break even has dropped again.

Zillow's latest breakeven horizon report, which delves into how long it takes for home purchasing costs to pay for themselves versus having spent the same amount of time renting, shows that DC area homeowners will break even in the shortest timeframe seen in recent years.

As of the first quarter of 2018, the median breakeven horizon for the region came in at 2.96 years. This is a 1.74 year drop compared to the last quarter of 2017.

story continues below

loading...story continues above

Despite being a surprisingly reasonable amount of time compared to previous quarters, the DC region's breakeven horizon is actually the sixth-longest natiwonwide, but shorter than Los Angeles/Long Beach (3.7 years) and San Francisco (2.98 years); Portland, Oregon (3.07 years); Hartford, Connecticut (3.23 years); and Virginia Beach (3.11 years).

The breakeven point is measured with a one-to-one comparison of the costs of purchasing vs. renting a random sample of 3,000 units in each zip code. The purchase price and rental rate of each dwelling is determined using the controversial Zestimate tool.

A home purchase assumes a 20 percent down payment; a 30-year fixed-rate mortgage at the current interest rate; ancillary costs like homeowner’s insurance, property taxes, 3 percent closing costs, and, where applicable, either 1.2 percent in annual condo fees or 1 percent of home value in annual maintenance costs; tax deductions; and predicted home price appreciation. Rental costs assume one month’s security deposit and renter’s insurance, while assuming that not having to pay home-associated expenses affords the renter a 5 percent annual accrual on the foregone down payment.

See other articles related to: breakeven horizon, buying versus renting, buying versus renting dc, renting vs. buying, zillow

This article originally published at https://dc.urbanturf.com/articles/blog/2.96-years-the-breakeven-horizon-for-dc-area-homeowners-gets-shorter/14006.

Most Popular... This Week • Last 30 Days • Ever

A look at the closing costs that homebuyers pay at the closing table.... read »

3331 N Street NW sold in an off-market transaction on Thursday for nearly $12 million... read »

Today, we take an updated look at the pipeline of larger residential development on t... read »

The development group behind the hotel has submitted for permit review with DC's Hist... read »

The map and text amendment applications that were filed with the Commission last Octo... read »

- How Do Closing Costs Work in DC

- Georgetown Home Sells For $11.8 Million, Priciest Sale in DC In 2024

- The 5 Developments In Various Stages Along the H Street Corridor

- Georgetown Hotel That Is Partnering With Jose Andres Looks To Move Forward

- The Zones That Could Lead To More Development in Chevy Chase Set To Go Before Zoning Commission

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro