Have DC Cooperatives Been Co-opted By Condos?

Have DC Cooperatives Been Co-opted By Condos?

✉️ Want to forward this article? Click here.

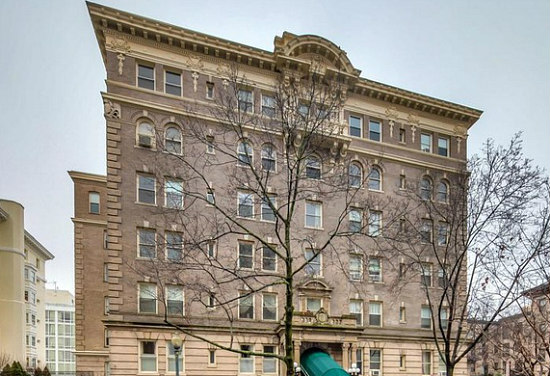

A co-op building at 2122 California Street NW.

Thousands of new condos have been built in the DC region over the last decade, and many more are in the pipeline. However, you don’t see any new co-ops being built, and a recent question from an UrbanTurf reader led us to try and find out why.

First, a refresher on co-ops. Co-ops are a style of homeownership where a person owns shares of a multifamily building, rather than having sole ownership of an individual unit like a condominium. Co-ops are governed by a board of residents, and all decisions about the building and the units within depend upon reaching consensus.

Cooperatives preceded condominiums by a few decades as a housing option, and according to the DC Cooperative Housing Coalition, the city has approximately 15,000 co-op units in over 120 buildings, with the first one being built in 1920. Co-ops in DC have traditionally been effective in creating and maintaining affordable housing in the city, as seen in communities like Sursum Corda or those created when apartment complex residents exercise their Tenant Right of Purchase Act (TOPA) rights, while co-ops in New York City have famously been more exclusionary and geared toward enticing wealthier households.

story continues below

loading...story continues above

However, there is not a really clear answer as to why co-ops aren’t built in the city anymore. New construction of for-sale, multi-unit housing has boomed in the region over the past several years — exclusively with condominiums. Co-ops here have not always been associated with luxury and developers may simply not see them as a smart alternative to more marketable condos.

Also, lack of familiarity and misinformation may sour public opinion on co-ops. For example, while people generally accept that co-op owners may encounter difficulties if they would like to rent their units out, it is a lesser-known fact that condo owners may experience the same.

Developer Martin Ditto points out that “cooperatives [were] suggested as a way to subdivide vertical space prior to the existence of the condominium law” and that today, conventional wisdom is that condominiums are a more attractive way to subdivide housing. This may ring particularly true in the District, which has developed a reputation for enticing out-of-towners who may not be as willing to commit to housing that requires a high level of engagement. Condos are often seen as a way to invest in real estate that offers a lower level of responsibility than a house and more flexibility than a co-op.

John Mashburn, current board president of the Harbor Square Cooperative in Southwest DC, sees the reluctance to construct or establish new cooperatives as symptomatic of a broader shift in values.

“Owners have to sometimes be willing to forego their individual needs/rights to some extent in order to act in the best interest of the common good under the coop form of governance to make it work — and I believe such sentiment is rarer than it used to be.”

See other articles related to: co-op fees, co-ops, co-ops dc

This article originally published at https://dc.urbanturf.com/articles/blog/why_no_new_construction_of_co-operatives/11114.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro