Trulia: Rent Increases Accelerating in DC

Trulia: Rent Increases Accelerating in DC

✉️ Want to forward this article? Click here.

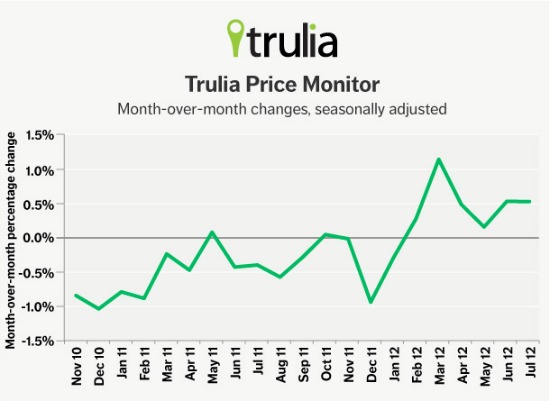

Courtesy of Trulia Trends

Data released today reveals that rent increases in the DC area continue to accelerate. In July, asking rents were up 3.9 percent year-over-year, following a 3.5 percent increase in June, according to Trulia’s latest Price and Rent Monitors, which were released this morning.

While that may seem like a notable increase, it paled in comparison to rents in other major market. Rents increased country-wide by 5.3 percent year-over-year, with six metropolitan areas —Seattle, San Francisco, Raleigh, Oakland, Miami and Lakeland-Winter Haven, FL — seeing increases over 10 percent.

“Rents increased year over year in 24 of the 25 largest rental markets, and rose faster than home prices in 21 of those 25,” Trulia Chief Economist Jed Kolko said. “In six major markets, rents increased by more than 10% year over year, with San Francisco clocking the largest increase at 12.4%. To put this into perspective, only two large rental markets had year-over-year rent increases of 10% or more three months ago.”

For more stats and analysis, click here.

A full explanation of Trulia’s methodology can be found here, but in short, the Price and Rent Monitors compare current asking prices and asking rents year-over-year and quarter-over-quarter, adjusting for seasonal swings.

Similar Posts:

- Champagne and Signing Bonuses: Welcome to San Fran’s Rental Market

- Capitol Riverfront and H Street See Big Rent Increases

- How to Rent Out That Spare Bedroom

See other articles related to: rent increase, renting, renting in dc, trulia trends

This article originally published at https://dc.urbanturf.com/articles/blog/trulia_rent_increases_accelerating_in_dc/5874.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

One of the most ambitious federal housing proposals in years is moving through the le... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- What Is In The Big New Housing Bill?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro