The Calm Before the Amazon-Fueled Storm? Apartment Absorption Down in Northern Virginia

The Calm Before the Amazon-Fueled Storm? Apartment Absorption Down in Northern Virginia

✉️ Want to forward this article? Click here.

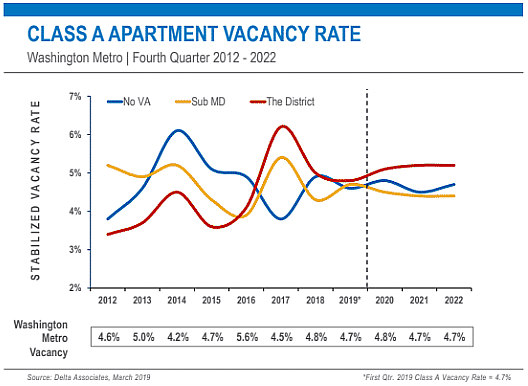

While anticipation of the 25,000 jobs Amazon is expected to add to a campus in National Landing has many questioning how the local rental market will be disrupted, the most recent quarterly report from Delta Associates offers a far less alarmist perspective.

The report describes the northern Virginia rental market as experiencing the "calm before the storm", with absorption of Class A apartments in this submarket down by 41 percent.

story continues below

loading...story continues above

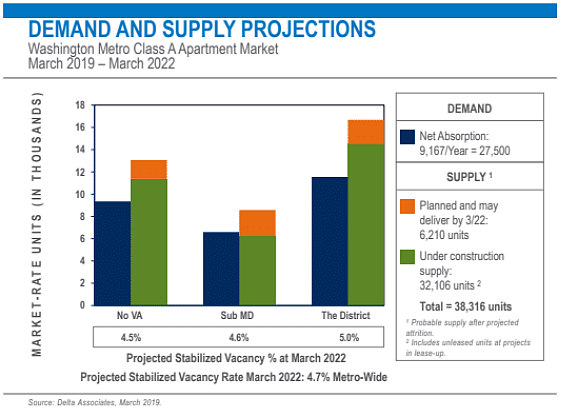

During the first quarter of 2019, 2,672 apartments broke ground across the metro area, although none were in northern Virginia. Roughly 15,918 Class A units are expected to deliver in the area through March 2020, almost twice as many as the 8,096 delivered in the year prior. Anticipation of increased competition encouraged growth in rental rates, which have increased by 2.5 percent for Class A apartments throughout the region.

"Rent growth was at or above the five-year average for both low-rise and mid-/high-rise product as new competition was limited," the report explains. "Looking at the pipeline of 7,600+ units projected to deliver over the next 12-month period in the substate area, the market is bound for major changes."

The report estimates that two-thirds of Amazon HQ2 employees will opt to rent or buy single-family houses and townhouses, leaving about 6,600 employees who will opt for a rental apartment or condo by 2030, maxing out at about 9,900 employees at full build-out in 2034. Of those 6,600 multi-family dwellers, 3,700 will opt for Class A apartments (up to 5,500 by 2034), and about 79 percent of those renters are expected to settle in northern Virginia.

By these estimates, Amazon employees will rent up to 2,600 Class A units in Arlington by 2034, with those units representing about 22 percent of the planned pipeline there. Another 700 Class A units in DC will be occupied by Amazon employees by 2034.

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

- Alexandria: $2,120 per month

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,860 per month

- Upper Northwest: $2,796 per month

- Columbia Heights/Shaw: $2,708 per month

- NoMa/H Street: $2,385 per month

- Capitol Hill/Capitol Riverfront: $2,540 per month

- Rosslyn-Ballston Corridor: $2,503 per month

- Silver Spring/Wheaton: $1,937 per month

- Bethesda: $2,698 per month

- Northeast: $2,099 per month

- Crystal City/Pentagon City: $2,442 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at Class A high-rise buildings in the DC area.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

This article originally published at https://dc.urbanturf.com/articles/blog/the-calm-before-the-amazon-fueled-storm-apartment-absorption-down-in-northe/15260.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

One of the most ambitious federal housing proposals in years is moving through the le... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- What Is In The Big New Housing Bill?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro