What's Hot: Just Above 6%: Mortgage Rates Drop To 2022 Lows | Facebook Co-founder Lists DC Home For Sale

Buying Now Twice as Affordable as Renting, Zillow Says

Buying Now Twice as Affordable as Renting, Zillow Says

✉️ Want to forward this article? Click here.

Buying a home is currently two times more affordable than renting one, and the divide is only growing, a new report from Zillow concludes.

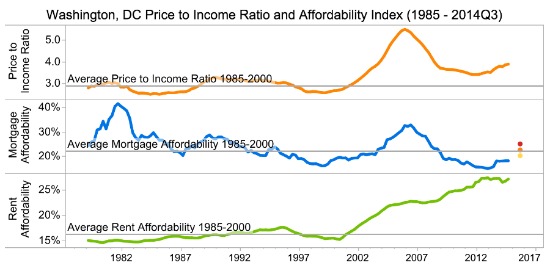

The study compared average affordability between 1985 and 2000, when buyers were paying about 22 percent of their income into their mortgage and a little more — 25 percent — into renting, with today’s affordability. Now, home owners are devoting about 15 percent of their income to their mortgage, while renters pay upwards of 30 percent towards the monthly rent. The advantage in favor of buying comes thanks to low interest rates and post-recession home prices, according to Stan Humphries, Zillow’s chief economist, who wrote about the report on Twitter.

Even potential buyers who would have to pay mortgage insurance and can’t pony up a large down payment would find it more affordable to purchase, according to the report, which took into account data from the third quarter of 2014. Renting has become historically unaffordable in California and all of the 35 biggest metros, Zillow noted.

The District follows this same pattern. In DC, renters are on average paying 27 percent of their monthly income into housing, up from an average of 16 percent between 1985 and 2000. Homeowners, on the other hand, are spending about 18 percent of their income on housing, down from 22 percent between 1985 and 2000. And first-time homebuyers, those whose home owning costs likely outpace long-time owners with more equity, are paying 24 percent of their income into housing — still less than a renter, according to a HousingWire analysis of Zillow’s data.

Humphries predicts that the discrepancy will continue to widen into next year.

“Affordability will force more renters to consider buying, especially younger renters,” he wrote on Twitter. “2015: Millennials become biggest buying group.”

See other articles related to: renting in dc, renting vs. buying, zillow

This article originally published at https://dc.urbanturf.com/articles/blog/renting_is_twice_as_expensive_as_buying_zillow_says/9312.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro