Property Values Rebound in a Few DC-Area Jurisdictions Since Recession

Property Values Rebound in a Few DC-Area Jurisdictions Since Recession

✉️ Want to forward this article? Click here.

An H Street home that sold for $273,000 in 2010 and $900,000 in 2014.

A shaky property tax base in the wake of the recession is still a problem for many DC-area jurisdictions, a researcher at George Mason University notes in a recent report.

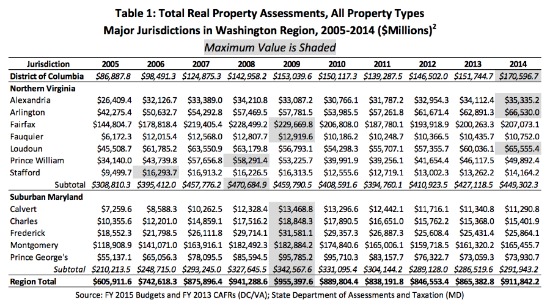

The somewhat dry-sounding report, “Real Property Assessment Trends in the Washington Region, 2005-2014,” offers an interesting take on property assessments in the region and gives insight into which jurisdictions have rebounded the most (and least) since 2009. The report’s author is David Versel, who’s previously told UrbanTurf about demographic trends in the DC area. Versel looked at property assessments to get a window into how local governments are faring financially.

The answer is: Pretty well, if you live in DC, Arlington, Alexandria, or Loudoun.

Versel shows that all 13 jurisdictions he analyzed saw property values decline in 2009, but since then, several have emerged from the pack, with Loudoun and Arlington at the front of the line. Both counties have seen property assessments rise more than 15 percent over their 2009 values. The rest of the jurisdictions have yet to even recover to pre-recession values, and two — Prince William and Stafford — reached their peaks before 2009 but haven’t recovered to those levels, Versel writes.

That’s bad for cities, which depend on revenue from property taxes to run. Versel specifically looked at how residential and nonresidential assessments differed for local governments as it’s “an important measure of the fiscal health of a jurisdiction.” The more nonresidential property the local government can assess taxes on, the less homeowners have to pay for the same or better city services they expect.

DC, Arlington and Alexandria have all done well by increasing the nonresidential share of their property tax base. (Loudoun has just built a lot of new houses.) The suburbs have “struggled to keep pace” with that reality, Versel writes, and meanwhile, more and more people are moving to cities anyway.

“Looking ahead, the region is expected to experience more of the high-density, transit-oriented development that has led recent real property assessment growth in many of its jurisdictions,” he notes. “This trend is placing additional burdens on residential property owners in these jurisdictions and making it more difficult for local governments to maintain their public facilities and services.”

See other articles related to: property assessments, property taxes

This article originally published at https://dc.urbanturf.com/articles/blog/property_values_rebound_post-recession_in_only_a_few_dc-area_jurisdictions/9282.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro