What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

New Study Outlines the Needs of Montgomery County Rental Market

New Study Outlines the Needs of Montgomery County Rental Market

This afternoon, the Montgomery County Planning Department will present to the Planning Board the final results of a study on rental housing in the county, the fruits of an 18-24 month effort to assess the county’s rental housing needs. The study is intended to identify rental housing needs and offer solutions that will help ensure a sustainable supply of affordable rental housing for a wide range of household demographics.

The study found that population growth and settlement in Montgomery County follows an urban/rural dichotomous pattern, with high density inside I-495 and along I-270. These areas are developing in an urban style despite being identified as suburban land. Relatedly, people aged 25-34 are gravitating toward transit centers while those 65 and older are clustering in more suburban, affluent areas. Demand for rental housing is steadily increasing as millennials and young Generation X-ers look to create more-affordable households and as others begin seeing renting as a less-burdensome alternative to owning a home.

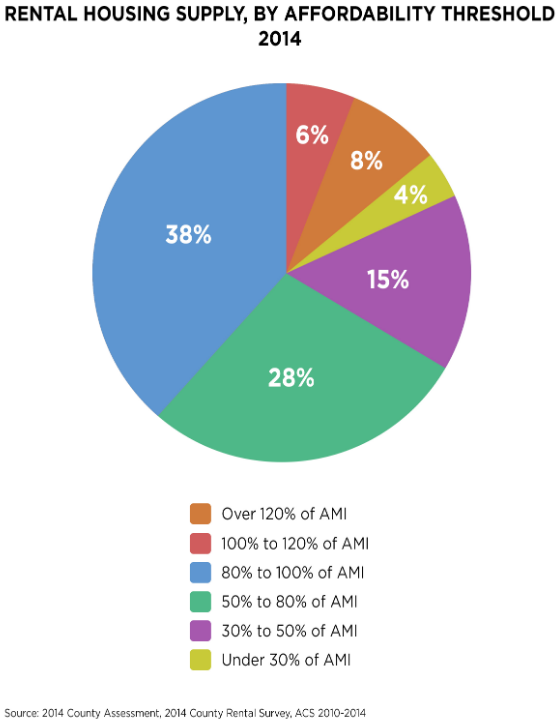

Breakdown of rental supply for various income levels

With that knowledge, the study discovered that one-third of all housing units in the county are rentals, primarily concentrated along transit lines and close to employment centers. While the county has an array of older rental developments that create naturally-affordable housing, overall market demand and post-recession income stagnation makes this affordability unsustainable. Half of renters spend over 30 percent of their annual income on housing and are thus cost-burdened. This imbalance is particularly salient for households earning up to 30 and 50 percent of area median income (AMI). As of April, the AMI for Montgomery County is $110,300.

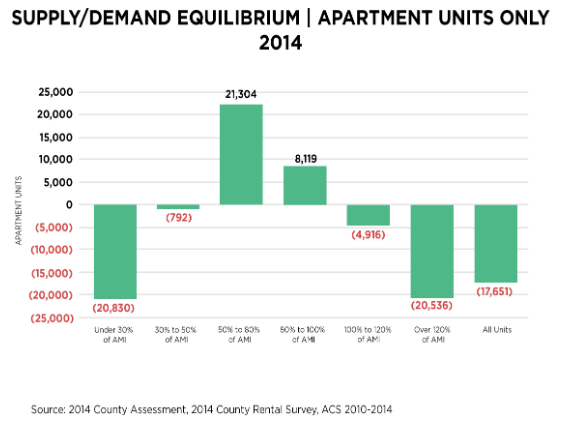

The study highlighted a few other problem areas in the county rental market. For one, very few three-bedroom units are affordable for households earning up to 80 percent AMI, and very few three-bedroom units are currently being built. Another disconnect is occurring among renters earning over 120 percent of AMI, who create additional competition in the market by renting units less expensive than they can afford. Meanwhile, there is a surplus of rental housing affordable to households earning between 50 and 100 percent of AMI.

Balance of supply and demand of rental apartments at various income levels

The study identified the following tools to address the county housing gaps:

- Currently, developers of buildings with 20 or more housing units are required to set aside 12.5 percent of the units for households earning up to 65-70 percent AMI. The study recommends the percentage be increased to 15, going up by 0.5 percent annually for the next five years. Five percent of those units should be set aside for households earning up to 50 percent AMI and the remainder for households earning up to 80 percent AMI.

- Adaptive reuse of existing buildings, reduced parking requirements and consolidation of public facilities should be encouraged. Tools that allow developers to attain bonus density should be expanded for developers willing to create projects with 20 percent affordable units. Public and vacant land should be identified and included in deals where available, perhaps in land swaps.

- Preservation of existing rental housing stock. An inventory of at-risk properties is necessary, and redevelopment or preservation of existing properties should be encouraged — especially considering that new construction typically costs $2-$5 per square foot. The right of first refusal provision should also be expanded to enable the county to partner up and purchase more properties for sale.

- Appropriations from the Housing Initiative Fund (HIF) should be increased and housing vouchers should be more readily available. The county should require developers to contribute to the HIF in lieu for small projects of 20 or fewer units and pay a fee or tax per demolished multi-family unit. Tax credits and refunds should incentivize preservation and rehabilitation of housing. The study also recommends a partnership with Prince George’s County to lobby the state for a 9 percent appropriation of low-income housing tax credits.

The Planning Board is just the first stop for the study. The consultants will also present the findings and recommendations of the study to the County Council’s Planning, Housing and Economic Development Committee next month.

This article originally published at https://dc.urbanturf.com/articles/blog/new_study_outlines_needs_of_montgomery_county_rental_market/12695.

Most Popular... This Week • Last 30 Days • Ever

This week’s Best New Listings includes a cozy home adjacent to the Arboretum, a pr... read »

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro