What's Hot: Nicklas Backstrom's $12 Million McLean Home Finds A Buyer | HPO Recommends Approval Of Georgetown Conversion

Mortgage Rates Fall Towards 6% Following Fed Cut

Mortgage Rates Fall Towards 6% Following Fed Cut

✉️ Want to forward this article? Click here.

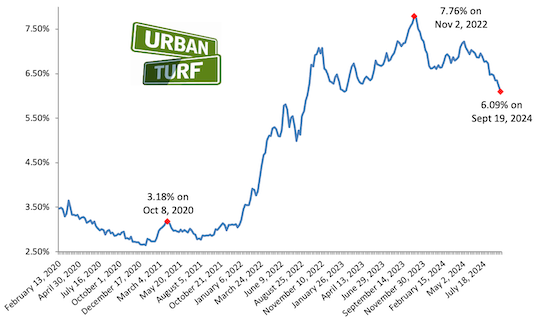

On Wednesday, the Federal Reserve cut interest rates by 50 basis points, and today, mortgage rates followed suit.

On Thursday, Freddie Mac reported 6.09% as the average on a 30-year mortgage, down 11 basis points from last week. Long-term rates are now at their lowest level since early 2023, and could continue to fall.

story continues below

loading...story continues above

“While mortgage rates do not directly follow moves by the Federal Reserve, this first cut in over four years will have an impact on the housing market," said Sam Khater, Freddie Mac’s Chief Economist. "Declining mortgage rates over the last several weeks indicate this cut was mostly baked in, but we expect rates to fall further, sparking more housing activity.”

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_rates_fall_to_6_following_fed_cut/22731.

Most Popular... This Week • Last 30 Days • Ever

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro