What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Millennials and Delayed Homeownership: Student Loans or Other Priorities?

Millennials and Delayed Homeownership: Student Loans or Other Priorities?

✉️ Want to forward this article? Click here.

There has been a lot of speculation about why millennials haven’t been willing or able to enter the housing market, with many signs pointing to the lingering impacts of the 2008 nationwide recession.

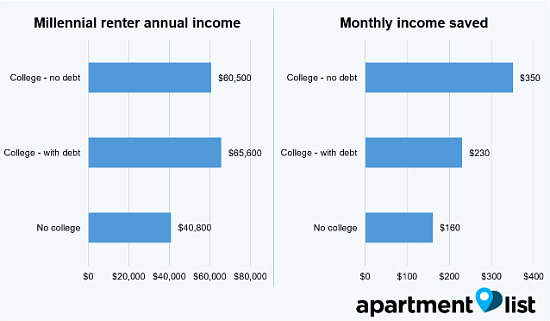

Now, ApartmentList has released an analysis on the impact of student loan debt on millennial homeownership. Among their findings was that regardless of whether college-educated millennials are carrying student loan debt or not, this demographic is more focused on discretionary spending than saving for a down payment.

At their current savings rates, it will take college-educated millennials with student loans ten years to save up for a 20 percent down payment. That period of time is cut in half for those with college degrees and no student debt. Millennials without college debt are also much more likely to receive assistance from family or friends to make a down payment than those with student loans.

story continues below

loading...story continues above

The report found that millennials who are not college graduates would need at least 15 years to save for a down payment — 19.3 years if attempting to purchase a home in DC.

Nationwide, 58 percent of millennials with college degrees are repaying an average of $410 toward their student loans every month. In DC, 52 percent of millennials with college degrees also have student loans in repayment, and nearly half pay at least $300 each month.

As for saving, college graduates without student loan debt put $320 of their monthly income toward a down payment, $90 more than graduates with student loans. While it follows that college graduates would be able to save significantly more if loan debt was out of the picture, college grads with or without debt spend comparable portions of income on activities like travel, shopping and dining out.

This article originally published at https://dc.urbanturf.com/articles/blog/millennials_and_delayed_homeownership_student_loans_or_other_priorities/11264.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro